Estate Planning for High School Graduates

Is Estate Planning really necessary for high school graduates? Yes! This spring and summer, many of our clients will watch their children graduate from high school. Many of these fresh graduates will move away to attend college, work new jobs, or perform volunteer work.

Some parents are surprised to learn that even an 18-year-old needs to do some basic Estate Planning. For the high school graduation gift that keeps on giving, we suggest giving basic Estate Planning documents including an Advance Healthcare Directive and Durable Power of Attorney.

Why Do High School Grads Need Estate Planning?

Most High School graduates are only 17-19 years old. Do they really need to be thinking about Estate Planning already? Yes; here’s’ why.

In the eyes of California law, a child is considered to be a legal adult on their 18th birthday. Once a child turns 18, some parents get a rude awakening when they call the doctor’s office and discover that they no longer have access to their adult child’s medical records. The same is true for working with banks on financial matters on a child’s behalf.

Parents are often shocked at the legal barriers imposed once their child reaches the magical age of 18. The best way to avoid legal roadblocks to make sure your young adult children get an Advance Healthcare Directive and Durable Power of Attorney.

High School Grads Need an Advance Healthcare Directive

An Advance Healthcare Directive (aka Medical Power of Attorney) is a legal document that allows a person to appoint an agent to make medical decisions for them if they cannot do so themself.

According to the American Bar Association, more than 2/3 of Americans do NOT have an Advance Healthcare Directive. If your adult child is in that category, it can be a problem.

Think about this: What would happen if your adult child went to college in another state and had a medical emergency? Without a signed Advance Healthcare Directive, you will not have any access to medical information regarding your child’s condition, nor will you have the legal authority to make healthcare decisions for them.

We know that it can be challenging for young adults to think about end-of-life decisions while in the prime of life. These choices can be difficult for even mature adults to contemplate.

However, consider all of the famous cases involved young adults who had accidents without creating medical Powers of Attorney – people like Karen Ann Quinlan, Nancy Cruzan, and Terri Schiavo. The families of these individuals ended up stuck in litigation for up to 15 years as they fought over whether their child should remain on life support indefinitely or be removed.

High School Grads Need a Durable Power of Attorney

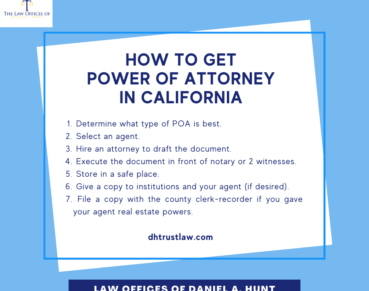

Another important document that every adult needs is a Durable Power of Attorney (POA). This document allows an agent (such as a parent) to act on a child’s behalf regarding financial decisions and any contracts.

Having a Power of Attorney comes in handy in a variety of scenarios. During your daughter’s semester studying abroad, who will deal with issues on the car she left behind? Who will sign a lease for a new apartment your son needs to rent when he returns from volunteering abroad?

A Power of Attorney gives you, as a parent and nominated agent, the power to act on your child’s behalf.

An Estate Planning Attorney Can Help

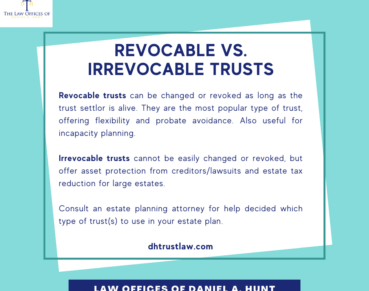

For assistance drafting these documents for your adult children, seek the counsel of an experienced Estate Planning attorney.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.