Which Type of Trust is Right for You?

Are you considering using a trust in your California Estate Plan? If so, you may be wondering: What’s the difference between the various kinds of trusts – and which type of trust is right for me?

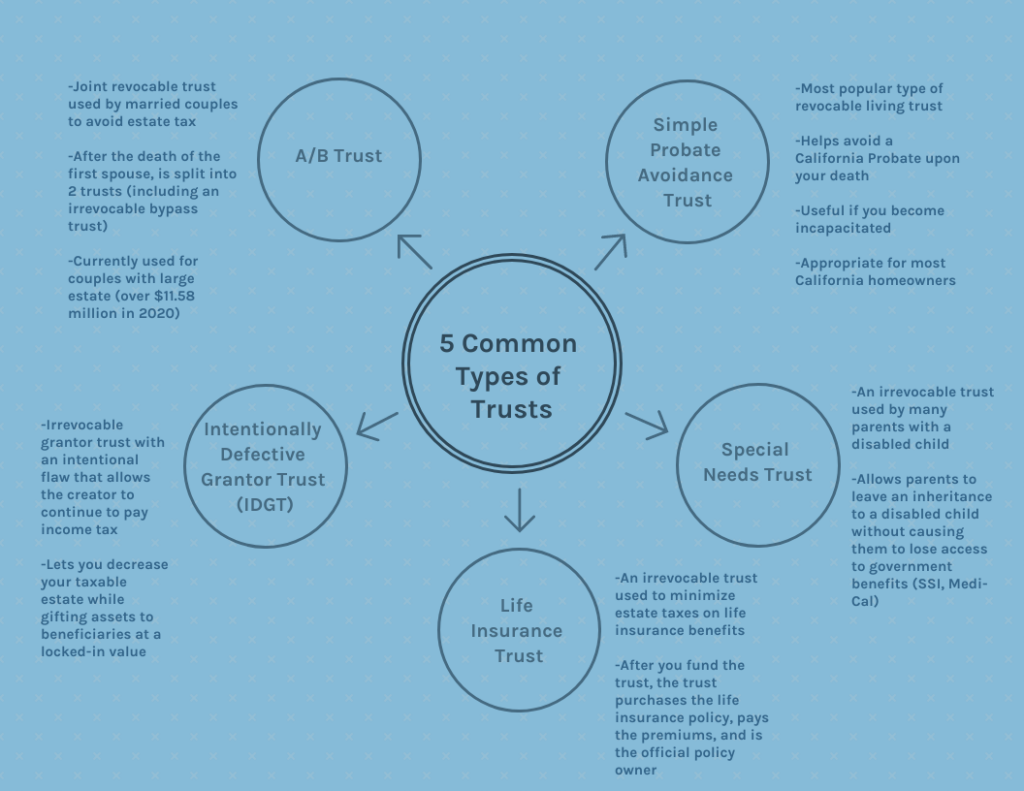

In this post, we’ll explore the difference between revocable and irrevocable trusts and 5 common types of trusts.

We strongly recommend meeting with an experienced Estate Planning attorney for personalized counsel on which type of trust(s) will most benefit your specific circumstances. Our goal here is to provide a helpful overview so you can be prepared with talking points for your initial consultation with your chosen attorney.

CALIFORNIA REVOCABLE LIVING TRUSTS

Revocable living trusts are by far the most popular type of trust with our clients. They are sometimes referred to as a “family trust” or “inter vivos trust” (that’s Latin for “a gift between the living”). A revocable living trust is created by a Settlor (or two Settlors for a married couple).

The Settlor(s) of the trust can revoke or cancel the trust at any time up until their death. They can also amend the trust when changes occur in estate planning law or their personal circumstances and desires. A revocable trust’s flexibility makes it very attractive and user-friendly.

After creating the trust, the Settlor then transfers their assets into the trust by changing the title on their assets from themself as an individual to themself as trustee of their trust. When they become incapacitated or pass away, their chosen representative, called a Successor Trustee, is responsible for administering the trust and distributing their assets when they pass away as outlined in the trust.

Why is it called “living”? A revocable living trust is used while you’re still alive. For example, if you become incapacitated, your chosen representative (called a Successor Trustee) would be able to act in your place while you’re still alive. This differs from a will, another popular Estate Planning document, which only takes effect upon your death.

TYPES OF REVOCABLE LIVING TRUSTS

#1 Simple Probate Avoidance Trust: The simplest and most popular type of revocable living trust. As the name implies, its main purpose is to avoid a California probate upon your death, although your Successor Trustee can also step in should you become incapacitated.

#2 A/B Trust: This joint trust can be used by married couples looking to minimize estate taxes. When the first spouse dies, the estate is split, or allocated, into two trusts. Trust “A” constitutes the living spouse’s half of the estate and Trust “B” represents the deceased spouse’s half of the estate. Once very popular when the estate tax exemption was around $1 million. Now that the estate tax exemption is much higher, $11.58 million in 2020, A/B trusts are relatively rare and used only by couples with very large estates.

CALIFORNIA IRREVOCABLE TRUSTS

Irrevocable trusts are designed for long-term asset management. When you create an irrevocable trust, you give up control/ownership of the property held in the trust. These assets are no longer considered part of your estate, nor are you liable for paying taxes on them. The assets will belong to the trust and the trustee you designate will oversee maintaining the assets in the trust and paying taxes on them.

Irrevocable trusts are difficult to change once created. Traditionally, you needed a Court Order and consent from the trust beneficiaries to change it. In 2019, trust decanting came to California and provided an easier way to change an irrevocable trust outside of the court system. Still, if flexibility is a major concern to you, you may want to consider using a revocable trust instead.

Irrevocable trusts offer the benefit of asset protection from future creditors and lawsuits. Your assets would also be shielded from Medi-Cal estate recovery. Because you as the settlor do not have access to the assets in the trust, most of your creditors typically will not be able to access those assets either.

Some exceptions exist on the asset protection offered by Irrevocable trusts. They’re still susceptible to child support claims, federal tax claims, alimony claims, and California state tax claims. Also, be aware that moving your assets to an irrevocable trust won’t protect them from current creditors with valid claims; that would be considered a fraudulent transfer.

3 TYPES OF IRREVOCABLE TRUSTS

#1 Special Needs Trust: A Special Needs Trust is an irrevocable trust that we often see parents create for the benefit of a disabled child. It allows the child to receive an inheritance from their parents’ estate without being disqualified from receiving government benefits such as SSI and Medi-Cal.

#2 Intentionally Defective Grantor Trust (IDGT): This is an irrevocable grantor trust with an intentional flaw that allows the creator to continue to pay income taxes. It allows you to decrease your taxable estate while gifting assets to beneficiaries at a locked-in value, essentially gifting additional wealth to your children/grandchildren/etc.

#3 Life Insurance Trust (ILIT): Life insurance death benefits may be subject to the estate tax in certain circumstances. For example, if the life insurance beneficiaries are dead and the death benefit becomes part of the estate. If the estate is very large (over $11.58 million in 2020), then estate tax would be owed. An irrevocable life insurance trust helps to avoid this tax. After you fund the trust, the trust would purchase the life insurance policy, pay the premiums, and be the official policy owner.

We hope this explanation has shed some light on the most common types of California trusts. There are certainly more varieties of trusts to explore. Be sure to meet with an experienced Estate Planning attorney who can offer personalized counsel and help you make the best choice for your estate and your loved ones. Feel free to contact us if you have any questions about trusts or if you’re ready to schedule a consultation.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.