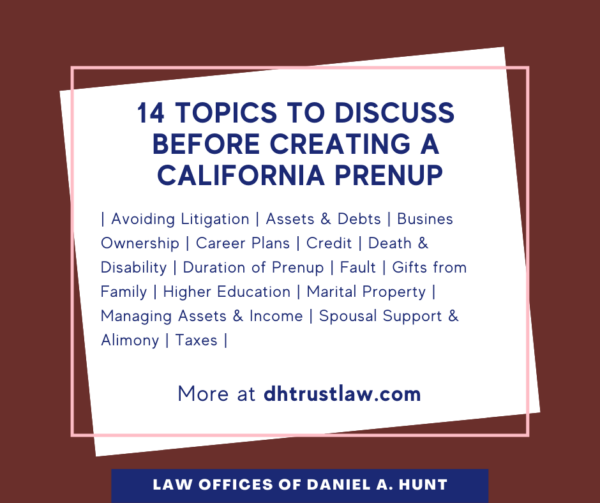

What to Discuss BEFORE Creating a Prenup

If you’re like many California couples who are planning to create a prenup before getting married, you may wonder what to discuss before creating a prenup. Prenups, also known as premarital agreements, lay out a clear plan for your financial future as a couple and what would happen in the event of a divorce. Using a thorough prenup checklist can help both partners think through relevant financial issues carefully before meeting with separate attorneys to draft a premarital agreement. Here are 14 topics to discuss before creating a prenup.

Avoiding Litigation

Do you want to add a clause to your prenup that states that in the event of a divorce, you choose to use an alternative dispute resolution process (like mediation) and avoid litigation?

Assets and Debts:

Each partner should make a complete list of all premarital assets and debts in their name. Next, consider:

- How will you handle premarital assets and debts in the event of a divorce? Will they remain separate property and go back to the person who accumulated them before the marriage? Or will your separate property be commingled with your marital property?

- If one person’s pre-marital property is used to pay off the other person’s premarital debts (for example school loans), will the paying party need to be reimbursed, or is it a gift?

- If you use premarital property to buy a home you’ll own together, will the paying party need to be reimbursed, or is it a gift?

- Are back taxes owed? If so, how will they be paid- jointly or individually? From which checkbook?

Business ownership

If you or your partner own a business as your separate property, consider:

- Would your prenuptial agreement include an indemnification (agreement to repay an obligation) on the business debts and taxes—business, personal, back taxes, payroll taxes?

- Are there issues with the type of business entity, like a subchapter S corporation or d/b/a, and how the corporate spouse determines their own income? Many small corporations have a lot of discretion with how much of the corporation’s income is taken as salary or income for the corporation’s officers or employees.

- Do you want to make provisions for forensic accountant or auditing books

in the event of a separation or divorce? - Do you want an agreement on how much income will be contributed to the

household and how much might be kept separate? - What if a premarital business starts a new business or subsidiary after the marriage?

- What if one of you works for the other person in a premarital business? There can be many “out of job market” issues, so negotiating your terms of employment with your spouse before joining the business can be an important step.

Credit

Have you seen each other’s credit reports? Consider:

- Does either of you have bad credit? Will you and your spouse jointly sign on new credit obligations?

- Discuss joint credit issues, as well as issues like pledging your home as collateral on business, or using a home equity line of credit to fund a business or tide it over in an economic downturn.

Death or Disability

If you don’t meet with an estate planning attorney to create or update an estate plan prior to the wedding, it’s imperative that you do so soon after your marriage, especially if you have children from a previous relationship. This will ensure that your assets and debts are handled the way you intend if you were to pass away.

Duration of the Premarital Agreement:

In your premarital agreement, you can designate how long the document remains in effect. A “sunset clause” allows you to set an expiration date on the agreement. Consider:

- Will the agreement ever expire? For example: After you have children together, or after 10, 20, 30, or 50 years of marriage?

- If you separate, does it matter who chooses to end the marriage or why?

- Will you wish to renegotiate the agreement at a specific time, like after 5 years of marriage or the birth of the first child?

Fault

California is a “no-fault” divorce state, meaning that the partner filing for the divorce does not have to prove that the other partner did something wrong (like an affair, substance abuse, etc.). But consider:

- Would it make a difference to you in your property settlement or spousal support if you felt one person contributed more to the breakdown of the marriage than the other person?

Gifts from Families

If one partner’s parents or relatives give a large monetary gift, loan, or home down payment, consider:

- Would this gift be separate property (of the spouse whose family gave the money), or community property (belonging to both partners)?

- If the gift is a loan, who would be responsible for repaying it, and how and when? How formal will you be with the documentation if it is a loan?

Higher Education

Sometimes one spouse will pursue higher education, leaving the other spouse to support them while they pursue a degree. Consider:

- Will one of you be attending college, graduate school, or professional school during the marriage? Will one of you have to support the other during this time? How will you deal with this sacrifice made by one person if the marriage doesn’t work out?

- How will any student loans that are taken out be repaid?

- Would the expectations about income and earnings change if one person wants to go back to school after you’ve been married for several years?

Marital (aka Community) Property

Marital (or “community”) property refers to assets and debts that you will accumulate together after your marriage. Consider:

- How will you handle the income and assets you accumulate together? Will they be joint and split equally, or will you use another arrangement?

Managing Assets and Income

Before getting married, consider and discuss the following aspects of managing assets and income together as a couple.

- Who will make the financial decisions and handle the checkbook? Will you do it together, or will one person be the primary financial manager?

- How will you handle large purchases as a couple? Does your spouse need to ask you before making a large purchase like a vehicle or luxury item?

- How will the household bills get paid, and whose responsibility is it to pay

them? - Will you have joint bank accounts, separate bank accounts, or both?

- Have you discussed your long-term financial goals (like retirement savings), and how each of you will contribute?

- Will the decision-making authority be different for pre-marital assets or debt?

- If one of you owes spousal or child support from a previous marriage,

how will those payments be made? From joint property or income, or separate property? If you separate or divorce, would the other spouse want or expect reimbursement for these payments made during the marriage? What if the obligation is informal—like voluntarily paying for an adult child’s college?

Spousal Support and/or Alimony

In California, spousal support is gender-neutral, meaning that either partner can request it from the other. Consider:

- Will there be any limitations on the amount, terms, and duration of support?

- In California, spousal support is often calculated as 40% of the paying spouse’s net monthly income, reduced by one-half of the receiving spouse’s net monthly income. Do you want to make terms about spousal support or alimony that are different from this norm?

- Do you both expect to work, and to contribute to the household? What are those expectations? Even if you think you’re in agreement, make sure you’re both going into the marriage with the same expectations about earnings and work.

- Would there be a circumstance that would lead to one partner not working, such as a health problem or birth of a child? What about going back to school? Does that change how you feel about spousal support or alimony?

Taxes

As a married couple, your finances will be intertwined for tax purposes unless you agree otherwise in your premarital agreement. Consider:

- Will you be filing your taxes separately or jointly?

- Does either partner currently have tax debt? If so, who will be responsible for that debt? Keep in mind that a refund received after the marriage could be seized to pay this premarital debt.

- Does either partner have questionable tax deductions or a lighthearted attitude toward filing taxes? Does that worry the other partner?

Working

What are your views on non-monetary contributions, like raising children or managing the household? Most states recognize these types of contributions during a marriage, but it’s important that you communicate your ideas on these types of roles prior to marriage. Consider:

- What kinds of jobs and income do you expect each partner to have?

- Does either of you anticipate a career change at any point in time?

- How would you feel if your spouse changed careers, such as to a high-risk job (like military or police) or a job with less pay (teacher or nonprofit sector)?

- When do you plan to retire – as early as possible, or do you plan to work as long as possible?

- Do you anticipate both partners continuing to work after having children, or would one of you stay home? For how long?

- How will you handle decisions about moving locations, like if one spouse is transferred for work to another state or wants to move closer to extended family after having children?

There are many issues to consider and discuss before creating a prenuptial agreement. An experienced attorney can help you craft a prenuptial agreement that reflects all of these nuanced situations. If you have any questions about prenuptial agreements, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.