What is Trustee “Self-Dealing”?

If you’re a trust beneficiary and you feel that the trustee is acting in their own personal interests instead of yours, you may wonder: What is trustee “self-dealing”? When a trustee favors their own interests over those of the beneficiaries during a trust administration, this action is called “self-dealing”. If you’re a trust beneficiary who suspects self-dealing by the trustee, you should understand what trustee self-dealing is and how to identify and handle it.

What is Trustee “Self-Dealing”?

A trustee has a fiduciary duty to act in the best interest of the beneficiaries. Under the California Probate Code Section 16004, “The trustee has a duty not to use or deal with trust property for the trustee’s own profit or for any other purpose unconnected with the trust, nor to take part in any transaction in which the trustee has an interest adverse to the beneficiary.”

Self-dealing is a form of breach of fiduciary duty that occurs when a trustee benefits from an action to the detriment of the trust beneficiaries. If the trustee is also a trust beneficiary, then self-dealing occurs when they benefit more from an action than the other beneficiaries.

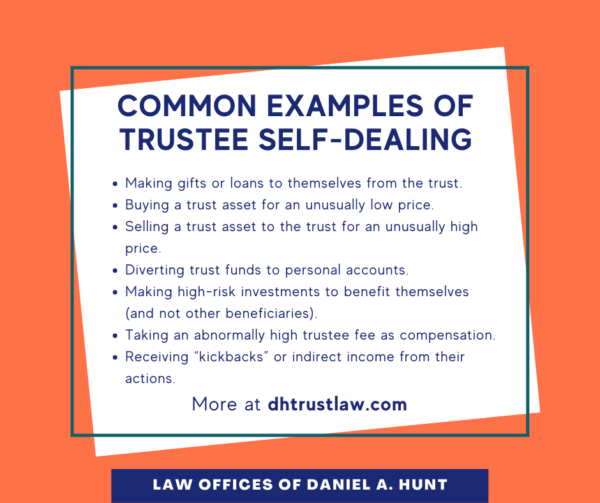

Examples of Trustee Self-Dealing

Self-dealing often involves the sale or purchase of trust assets. Here are some common examples of trustee self-dealing:

- A trustee making gifts or loans to themselves from the trust.

- A trustee buying a trust asset for an unusually low price.

- A trustee selling a trust asset to the trust for an unusually high price.

- A trustee diverting trust funds to personal accounts.

- A trustee making high-risk investments to benefit themselves (and not other beneficiaries).

- A trustee taking an abnormally high trustee fee as compensation for their services.

- A trustee receiving “kickbacks” or indirect income from their actions.

How to Identify Trustee Self-Dealing

How can a beneficiary know when self-dealing has occurred? All acting trustees have a duty to account for their actions annually to the trust beneficiaries. If you suspect that self-dealing may be occurring, beneficiaries can carefully review the annual accounting and look for any of the types of actions listed above.

If you observe suspicious activity in the annual accounting or if key information is missing, you may wish to retain legal counsel to protect your inheritance.

How to Handle Trustee Self-Dealing

If you are a beneficiary and you suspect the trustee of engaging in self-dealing, you’ll want to find the best trust litigation attorney possible to represent your interests. Usually, a trust litigation attorney will start with a letter to the trustee’s attorney demanding more information. Then they can guide you through the next logical step, from mediation up to a full-blown court trial.

An experienced trust and estate litigation attorney can help you seek to replace the trustee if desired and recover any monetary losses incurred due to the trustee’s self-dealing. If you have any questions regarding trustee self-dealing, feel free to contact our law firm for legal advice.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.