What is Trust Decanting?

What is trust “decanting” and how can it help you? Effective January 1, 2019, the California legislature enacted SB 909, The Uniform Trust Decanting Act. To understand this new California law, we must first understand a bit about wine.

WHAT IS DECANTING?

To decant wine is to pour it from the wine bottle into another vessel, leaving behind unwanted sediment and bringing the wine into contact with oxygen. Decanting is a popular way to enhance the flavor of a wine.

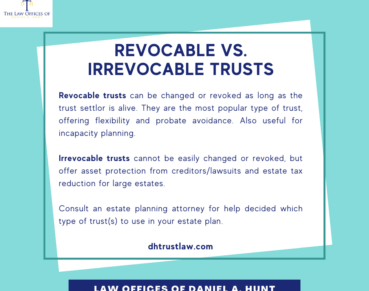

What does this have to do with California trust law? The Uniform Trust Decanting Act allows you to change the terms of an irrevocable trust by “pouring” trust assets from an old trust instrument to a new trust. This allows you to leave behind unwanted restrictions and provisions, just as you leave behind unwanted sediment when you decant a bottle of wine.

Prior to the act, modifying the terms of an irrevocable trust was very difficult. To modify the trust, you needed court approval and consent from all the trust beneficiaries. Now, decanting provides an easier way to modify an irrevocable trust outside of the court system. However, you must still notify trust beneficiaries of the proposed changes and allow them the opportunity to object to any changes.

There are limits to which terms of the trust can be changed, depending on the Trustee’s distribution authority in the original trust. The more distribution authority is given to the Trustee, the more changes can be made to the new trust. For example, if the current trust states specific limits on distribution (like requiring the funds to be used for the beneficiaries’ health, education, maintenance, and support), then the new trust must contain the same provision.

POSSIBLE CHANGES TO TRUSTS

Possible changes you can make to your trust by decanting include the ability to:

- Eliminate (but not add) current or remainder beneficiaries

- Make current beneficiaries remainder beneficiaries and vice versa

- Change standard for distributions

- Add or eliminate spendthrift provisions

- Eliminate, modify, or add powers of appointment

- Change Trustee provisions

LIMITS ON CHANGES TO TRUSTS

You will not be able to make the following changes by decanting:

- Increase Trustee compensations

- Relieve Trustee from liability

- Grant another person power to remove or replace Trustee

ALLOCATED A/B TRUSTS

Trust decanting is most applicable to clients who have an allocated A/B trust (aka Bypass Trust). What is an allocated A/B trust? It is an A/B trust that has been “allocated”, or split in half, after the death of the first spouse.

A/B Trusts can be a useful estate planning tool, but they aren’t used as frequently as they were in the past. At our office, A/B trusts were commonly used by married couples up until around 2012. Back then, the Federal Estate Tax exemption was around $1 million, meaning that if your estate was worth more than $1 million upon your death, it would incur an Estate Tax. Because of this, clients with estates that were worth near or over $1 million at that time chose to create an A/B Trust because of the potential tax savings it offered.

Today, the Federal Estate Tax exemption level is much higher than in years past. In 2020, the Estate Tax exemption is $11.58 million per individual. This means that if you die with less than $11.58 million, your estate will not incur an Estate Tax. If your estate is larger than $11.58 million, then an A/B Trust would likely still offer you Estate Tax benefits.

Most of our clients do not have over $11 million. Because of the higher exemption amount, A/B Trusts are now relatively rare and used only for very large estates. Most of our Estate Planning clients now create Probate Avoidance Trusts instead.

WHY DECANT AN ALLOCATED A/B TRUST?

Many clients who had an A/B Trust drafted in the past and who split their trust after the death of their spouse are now simplifying their lives by decanting their A/B Trust. In other words, they are replacing their “B” Trust with a simple probate-avoidance trust. Here’s why.

An A/B trust directs that at the passing of the first spouse, the trust estate must be split into two sub-Trusts: Trust “A” (which represents the living spouse’s share) & Trust “B” (which represents the deceased spouse’s share). Some people remember the “A” as representing the “above-ground” spouse and “B” as representing the “below-ground” spouse.

The “B” Trust would normally be funded with the deceased spouse’s separate property and/or their half of the community property. This locks in these assets to avoid Federal Estate Taxes. The “B” Trust becomes irrevocable; all other assets are kept in the “A” Trust, which remains revocable. This process is called “allocating” an A/B Trust.

CHALLENGES FOR SURVIVING SPOUSES

There are several drawbacks to allocating an A/B Trust. One disadvantage is that the living spouse loses access to the assets placed into the “B” Trust. If given the option, most living spouses would like to maintain access to all estate assets after their spouse’s passing. This can be especially beneficial if assets in the “A” Trust begin to dwindle.

Another drawback relates to Capital Gains tax exposure. The basis for assets allocated to the “B” Trust is locked in with the assets’ values as of the date of the deceased spouse’s death. Over the years, these assets often appreciate, which subjects the assets to potentially hefty Capital Gains taxes. Any increase in value between the date of the first spouse’s death and the date of the second spouse’s death is subject to Capital Gains tax.

TRUST DECANTING CAN HELP

Fortunately, decanting offers an alternative solution to surviving spouses. Now, the irrevocable “B” Trust can be decanted so that “B” Trust assets are placed in a new trust. Thus, these assets become part of the surviving spouse’s estate. The assets then become accessible for the surviving spouse to use. The assets also receive a new step-up in tax basis at the surviving spouse’s death, eliminating or minimizing Capital Gains exposure.

If you have an allocated A/B trust and would like to discuss decanting, feel free to contact our law firm. As a general rule, we recommend having your Estate Plan reviewed every five years or so. If you have an allocated A/B Trust, let’s talk about simplifying your estate plan.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.