What is a Special Needs Trust?

A Special Needs Trust can be an important part of an Estate Plan for parents with disabled children. After revocable living trusts, the type of trust most frequently created by our firm is the Special Needs Trust.

What is a Special Needs Trust?

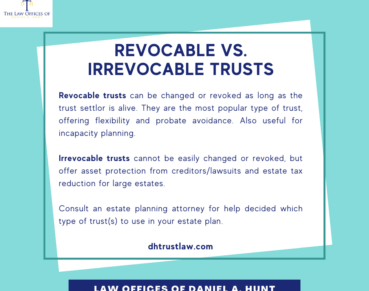

What is a Special Needs Trust (SNT)? It is a type of irrevocable trust that, according to the California Department of Healthcare Services, “allows for a disabled person to maintain his or her eligibility for public assistance benefits, despite having assets that would otherwise make the person ineligible for those benefits.”

First-Party vs Third-Party SNTs

There are 2 types of Special Needs Trusts: First-Party Funded and Third-Party Funded.

First-party SNTs are funded with assets that belong to an individual under the age of 65 who is receiving governmental benefits. An example of a first-party SNT would be a disabled person who receives a lawsuit settlement and creates an SNT for themselves to preserve their government benefits.

First-party SNTs must include federal and state provisions that require giving notice to the State when the trust beneficiary dies or the trust is terminated. The funds received through government benefits will need to be paid back at that time.

Third-party funded SNTs are easier to set up and do not require a payback clause. They are funded with assets belonging to a person other than the trust beneficiary, and to which the beneficiary never had possession or legal interest.

For the purposes of this article, when we mention a Special Needs Trust, we are talking about a third-party funded SNT. They encompass the common scenario where a parent of a child with a disability creates and funds a trust for that child’s benefit to prevent the loss of government benefits.

Why Create a Special Needs Trust?

Disabled or ill Californians can receive support from the Federal government in the form of Medi-Cal (California’s version of the federal Medicaid program) and SSI. (SSI, or Supplemental Security Income, helps elderly and disabled people who have little or no income by providing cash to meet basic needs like food, clothing, and shelter.)

However, Medi-Cal and SSI limit the amount of financial resources recipients can own. They do this to try to ensure that the funds are benefiting the truly needy. In 2020, the resource limit is $2,000 for an individual. So if a disabled child is left an inheritance that is over $2,000 after the death of a parent, they would no longer be eligible to receive governmental benefits.

This is often problematic, for several reasons. The inheritance received may be less than what they would have received from continued government benefits. Worse, if the disabled person has special medical needs, medical expenses could quickly and easily devour the inheritance funds and leave them without means of support. After the inheritance is used up, the disabled child can re-apply for benefits, but this causes a disruption and degree of uncertainty that most concerned parents would want to avoid if possible.

Unfortunately, in the past, many parents had to make the difficult decision to disinherit a disabled child in their estate plan to prevent a disruption in government benefits. Fortunately, today there is a better solution to this problem. Creating a Third-Party Funded Special Needs Trust ensures that a disabled child can receive an inheritance when their parents pass and also continue to receive SSI and Medi-Cal benefits.

How a Special Needs Trust Works

A Special Needs Trust is a type of irrevocable trust that continues as long as the person with disabilities is alive or until funds run out. The Trust is managed by an independent Trustee for the benefit of the disabled child. Assets included in the Trust will not be viewed as being owned by the disabled child and can be used for the child’s health, maintenance, education, and support, beyond the basics covered by Medi-Cal.

Selecting a Trustee

When creating a Special Needs Trust, parents often name themselves as the Trustee, with other family members listed as Successor Trustees. Others name a professional Trustee who is knowledgeable as to what the SNT can pay for without triggering a loss of benefits.

Whoever serves as Trustee, it’s important that they learn the rules of what the SNT can pay for without triggering a loss of benefits.

When to Create a Special Needs Trust

A Special Needs Trust should be created before the parents pass away. Since life is uncertain and we never know for sure when we will die, another way to say this is: today! Don’t delay creating a SNT until it’s too late. If you have a disabled child and are concerned about them being provided for when you’re gone, meet with an experienced Estate Planning attorney now to create a plan for the future.

How to Create a Special Needs Trust

Counsel with an experienced Estate Planning attorney to create a Special Needs Trust. They can give you personalized advice on how best to ensure your family will be taken care of in your absence.

The cost of a California Special Needs Trust varies, but at our firm, the cost is $1500 when combined with a regular revocable living trust or $3,000 on its own. Often clients choose to use both kinds of trusts in their Estate Plan.

A Special Needs Trust can be an excellent tool to provide for disabled children after their parents are gone. If you or someone you know needs help planning care for a disabled child, feel free to contact our firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.