What Happens to a Conservatorship When the Protected Person Dies?

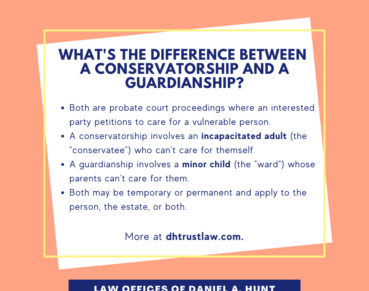

Adults are considered capable of managing their own financial and legal affairs, unless a judge determines otherwise. Judges can establish conservatorships for impaired adults, called conservatees, who cannot manage their affairs. Conservatees are often the victims of catastrophic illness or are developmentally disabled. When a conservatorship becomes necessary, a family member can petition the court to appoint a conservator who will manage the conservatee’s affairs. The conservator will continue representing the conservatee unless a significant change occurs. What happens to a conservatorship when the protected person dies?

Conservatorships Continue Until the Protected Person Dies in Many Cases

Conservatorships will continue until the conserved person dies. Courts and conservatorship attorneys typically refrain from using the term “permanent conservatorship.” There is always a possibility that the conservatee will be able to regain his or her independence. However, in some cases, especially those involving elderly conservatees or people with severe disabilities, the conservatorship will last until the conservatee passes away.

There are only two ways to end a conservatorship under the California probate code. A conservatorship continues until terminated by the conservatee’s death or by a court order. When the conservatee dies, the conservatorship terminates as a matter of law. However, this does not mean that the conservator does not have any power over the conservatee’s assets after he or she dies. According to California Probate Code §2467, the conservatee “continues to have the duty of custody and conservation of the estate after the death of the . . . conservatee pending the delivery thereof to the personal representative of the . . . conservatee’s estate or other disposition according to law.”

Limited Conservatorships and the Death of the Protected Person

The rules related to when a conservatorship stops vary depending on the type of conservatorship involved. As mentioned above, a general conservatorship will end upon a court order or the protected person’s death. In a limited conservatorship, the conservatorship terminates on the death of the protected person, by court order, or by the death of the limited conservator.

A mental health (LPS) conservatorship will stop automatically after one year, upon the conservatee’s death, or by court order. Unlike other types of conservatorships, an LPS conservatorship can be established for one-year time periods.

A Final Accounting Is Required After the Protected Person Dies

Conservators must still provide a final accounting, to be composed into different parts, under the California probate code. The accounting will involve the conservatorship of the deceased protected person’s estate. The conservator will need to account for the period that ended on the conservatee’s death date. The conservator will also need to provide separate accounting for the period after the conservatee’s death.

In other words, after the death of the protected person, the conservator must file and obtain approval from a probate court regarding the final account of the administration. The court will continue to have legal jurisdiction over the conservatorship after the conservatee dies. However, the Court’s authority is limited to settling the conservatee’s accounts or to enforce any judgments and orders of the court on the conservatee’s accounts. The court has jurisdiction over any other issue related to the termination of the relationship between the conservator and conservatee.

Can a Court Waive the Final Accounting?

Sometimes our clients ask us if the final accounting can be waived. Under California law, no statutory authority exists that provides conservators the right to petition the court to waive the financial accounting. On the other hand, no statute prohibits a court from waiving the final accounting when conservators do not want to incur the delay and expense of a final accounting. If you are a conservator, you will need to compile a final accounting and submit it to the court. If you are unsure whether a court will waive the final accounting, we suggest talking to an experienced conservatorship lawyer who will advise you on your legal options.

The Probate Process After a Protected Person Dies

What happens if the conservator is also the protected person’s personal representative for estate purposes? Sometimes the court will appoint the conservator to act as the personal representative during the probate process. If the personal representative was also the conservator, the conservator now has additional, specific fiduciary duties. For example, the conservator who is now the personal representative cannot use his or her position as a personal representative to benefit himself or herself.

Specifically, the personal representative cannot ask the court for relief from giving a final accounting as a conservator to benefit himself or herself. The probate court may allow a waiver of the conservatorship accounting, but only if the protected person’s estate beneficiaries also execute the waiver. Suppose you acted as a conservator and the protected person died, and you become the personal representative. If you ask the court to waive your requirement to file a final accounting as the conservator, the people or person who will benefit from the protected person’s estate must permit you to do so.

The Benefit of Speaking to an Experienced Probate Lawyer

Conservatorships are one of the more complicated areas of probate law in California. As a conservator, you have specific fiduciary duties to your protected person, and you must fulfill all of these duties. Even though the conservatorship itself and when your protected person dies, you still must submit a final accounting. If you are also acting as a personal representative, you need an attorney to ensure you meet your legal obligations.

Contact a Sacramento Conservatorship Lawyer Today

Do you have questions about what will happen to a conservatorship when a protected person dies? Are you a conservator who has just learned that your conservatee has passed away? If so, you probably have questions about the process of ending the conservatorship or about conservatorship in general. Contact the experienced probate lawyers at the Law Offices of Daniel Hunt today to learn how we can help you through the process of ending a conservatorship.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.