Trustor vs Trustee: What’s the Difference?

“Trustor” and “Trustee” are two similar terms you often hear in estate planning discussions. But what is a trustor versus a trustee, and what’s the difference?

What is a Trustor?

A trustor is a title for a person who sets up a trust. This person may also be called the trust grantor or settlor.

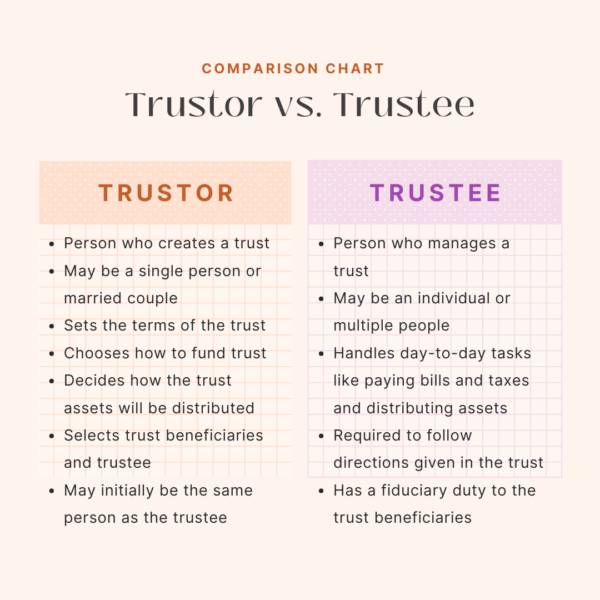

The trustor may be a single person or a married couple. They decide the terms of the trust, who the beneficiaries of the trust will be, and how their assets will be distributed. They decide how to fund their trust, meaning which assets they will transfer into it. And they will select a trustee to manage the trust.

What is a Trustee?

A trustee is the person who manages the trust. They are responsible for managing the assets in the trust by handling day-to-day tasks, paying taxes and bills, and ultimately distributing the trust assets to the intended beneficiaries after the trustor passes away.

Most trustors select a responsible, trustworthy family member or friend as their trustee. If they don’t personally know someone who fits this bill, they may opt to name a professional fiduciary to serve as their trustee.

A trustee is legally bound to administer the trust according to the terms of the trust. They have a fiduciary duty to act impartially and in the best interests of the trust beneficiaries.

Can you name multiple co-trustees? Yes, you can name two or even three co-trustees. But keep in mind that this typically increases the complexity and cost of the trust administration due to the increased need for communication and consensus-based decision-making.

Can a Trustor and a Trustee be the same person?

Whether the trustor and trustee can be the same person depends on the type of trust being created. The most common type of trust is a revocable living trust, often used to avoid probate.

With a revocable trust, the trustor and the trustee are initially the same person. The trustor continues managing their assets just as they did before they created a trust. Once the original trustor becomes incapacitated or dies, then their successor trustee steps into the trustee role.

With an irrevocable trust, the trustee is a different person from the trustor. That’s because irrevocable trusts offer asset protection and tax advantages by placing assets outside of your control in a trust that is managed by a trustee other than you. Consult an experienced trust attorney for advice on which type of trust would work best for your needs.

What’s the Difference Between a Trustor and Trustee?

A trustor is the person who creates a trust and names a trustee. The trustee follows the direction given within the trust document to manage the trust. The trustor and trustee may be the same person, but not always. If they are different people, then the trustor and trustee work together with the ultimate goal of protecting the trust assets and eventually distributing them to the beneficiaries.

If you have any questions about a trustor vs. trustee, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.