Understanding the Prudent Investor Rule for Trustees

The role of a trustee is one of the highest forms of fiduciary duty. Trustees must follow the Prudent Investor Rule, a fundamental principle guiding trustees as they manage trust assets. This rule sets the standard for fiduciaries, emphasizing prudent, well-informed investment strategies. If you need help understanding the Prudent Investor Rule for trustees, read on. We’ll delve into the Prudent Investor Rule, its implications for trustees, and best practices for compliance.

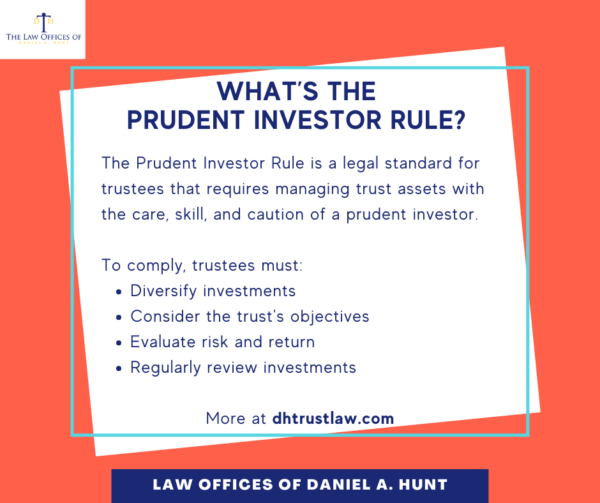

What is the Prudent Investor Rule?

The Prudent Investor Rule is a legal standard for trustees that requires managing trust assets with the care, skill, and caution of a prudent investor. Originating from the Uniform Prudent Investor Act (UPIA) adopted in 1994, the rule replaced the older Prudent Man Rule, which was more restrictive in its approach to investments.

Under the Prudent Investor Rule, trustees must:

- Diversify Investments: Spread investments across various asset classes to minimize risk and enhance potential returns.

- Consider the Trust’s Objectives: Align investment strategies with the specific goals and needs of the trust and its beneficiaries.

- Evaluate Risk and Return: Balance risk and return objectives in accordance with the trust’s purposes and the beneficiaries’ interests.

- Regularly Review Investments: Continuously monitor and adjust the investment portfolio to respond to changing market conditions and trust requirements.

Key Principles of the Prudent Investor Rule

Let’s examine some key principles of the Prudent Investor Rule.

Diversification

Diversification is essential in managing investment risk. Trustees must avoid putting all assets into a single investment or type of investment. Instead, they should construct a balanced portfolio that includes a mix of asset classes, such as stocks, bonds, real estate, and other investments. This approach helps mitigate the impact of poor performance in any single investment.

Consideration of the Trust’s Purposes

Every trust has unique goals, whether it’s providing for a beneficiary’s education, supporting a charitable cause, or preserving wealth for future generations. Trustees must tailor their investment strategies to align with these objectives, ensuring that the trust’s purposes are met.

Risk and Return Analysis

Trustees must strike a balance between risk and return, recognizing that higher returns often come with increased risk. The Prudent Investor Rule requires trustees to consider the overall trust portfolio, rather than evaluating individual investments in isolation. This holistic view helps achieve a balance that meets the trust’s financial goals while appropriately managing risk.

Regular Review and Adaptation

The investment landscape is dynamic, with market conditions and economic factors constantly evolving. Trustees must regularly review the trust’s investment portfolio, making adjustments as needed. This ongoing assessment is crucial for maintaining a prudent investment strategy.

Best Practices for Trustees

To effectively adhere to the Prudent Investor Rule, trustees should adopt the following best practices:

1. Develop a Comprehensive Investment Policy Statement (IPS)

A Comprehensive Investment Policy Statement (or IPS) serves as a roadmap for managing the trust’s investments. It outlines the trust’s objectives, risk tolerance, investment strategies, and guidelines for selecting and monitoring investments. A well-crafted IPS provides clarity and direction, ensuring consistency in decision-making.

2. Engage Professional Advisors

Trustees often benefit from the expertise of financial advisors, investment managers, and legal professionals. Engaging these experts can help trustees navigate complex investment decisions, stay informed about market trends, and ensure compliance with fiduciary duties.

3. Document Decisions and Actions

Maintaining thorough records of investment decisions, including their rationale, is essential for demonstrating prudent management. Documentation provides transparency and accountability, protecting trustees from potential legal challenges.

4. Stay Informed and Educated

The financial world is ever-changing, and trustees must stay informed about economic trends, regulatory changes, and new investment opportunities. Continuing education and staying abreast of industry developments can enhance a trustee’s ability to make sound investment decisions.

5. Regularly Review and Adjust the Portfolio

Frequent portfolio reviews are critical for maintaining alignment with the trust’s goals and adapting to changing market conditions. Trustees should conduct periodic evaluations and make necessary adjustments to ensure the portfolio remains diversified, balanced, and aligned with the trust’s objectives.

Following these principles will help trustees fulfill their obligations under the Prudent Investor Rule. Trustees should seek guidance from an experienced trust administration attorney to ensure they comply with all legal requirements.

If you have any questions or need help understanding the Prudent Investor Rule for Trustees, please contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.