How to Locate Estate Assets

When a loved one dies and you are the named Successor Trustee or Executor, you will need to locate and inventory all of the decedent’s assets. If you were already acting as the Trustee or under a Durable Power of Attorney prior to their passing, you may already have a decent grip on their financial situation. But if you weren’t, creating an asset inventory may feel like a daunting task.

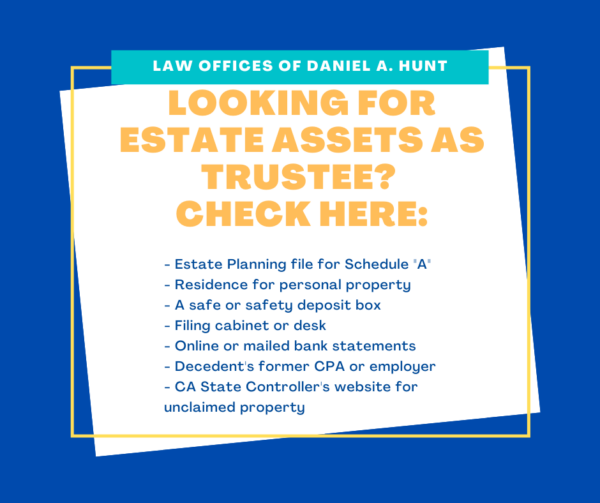

Here are 7 tips to help you conduct a successful asset search during an estate administration.

#1 Review their Estate Planning file for a Schedule “A”.

If the decedent created a revocable living trust, they probably also created a document called a Schedule of Assets or a Schedule “A”. This is a list of their financial assets on the date they created the trust. These assets may include real property, bank accounts, investment accounts, brokerage accounts, promissory notes, retirement accounts, life insurance, personal property, and more.

Ideally, this document is updated about every 5 years to provide current information that the Successor Trustee can efficiently collect all the trust assets after the Settlor dies.

If you can locate copies of the decedent’s trust documents or an Estate Planning file at home, check for a schedule of assets. If you can’t find this information, contact the attorney or law firm that prepared the documents and request a copy. A Schedule “A” makes a great jumping-off point in your quest to locate the assets of the trust.

#2 Check all potential paperwork storage locations, including safes, safety deposit boxes, and at-home filing cabinets or desks.

Many people purchase a fireproof safe for their home so they can store confidential financial information, valuables, and more. If the decedent had a safe and you don’t know the combination to open it, you may need to see a locksmith for assistance.

Another common storage option is a safe deposit box at a bank. If you don’t have a key to access the safety deposit box, you’ll need to wait 40 days after the decedent’s date of death, and obtain a death certificate and a Small Estate Affidavit in order to access the contents of the safety deposit box.

Finally, most people have a filing cabinet, desk, or another place in their home for storing financial paperwork. Sorting through voluminous paperwork is time-consuming, especially if the decedent kept many years of financial records. But you’ll want to review everything to ensure you don’t miss any hidden or forgotten assets.

#3 Monitor the mail and check online accounts for financial account statements.

If you have access to the decedent’s incoming mail, be sure to monitor for bank statements. You can also forward the decedent’s mail to your address through the US Postage Service.

If the decedent opted for paperless statements, you’ll want to access their online accounts with each institution. Ideally, they left you a letter of instruction with a list of passwords to access all of their digital accounts. If they didn’t but you have access to their computer, you may be able to access passwords there. If you can access their email account, you can likely reset any other account passwords that you’re unable to find.

#4 Check with the decedent’s CPA and/or review tax returns.

If you know the name of the decedent’s CPA, they may be a good source for past tax returns and the financial information they include. You can also check for folders in the home that may include tax records.

#5 Contact the decedent’s most recent employer for retirement accounts or life insurance policies.

Some employers offer retirement accounts and life insurance policies to their employees. You may want to double-check with the decedent’s last employer, especially if the employment was recent, to make sure you aren’t overlooking any such policies in your asset inventory.

#6 Search the home for valuable personal property.

Some estates include high-value personal property such as jewelry, coins, and collectible items. To complicate matters, high-value items may be mixed in with ordinary ones. Be especially careful if the Settlor had a tendency to hide money. Like the proverbial Depression-era grandparents who distrusted banks and buried money in jars in the backyard, it’s possible that funds were stashed at home for safekeeping.

Case in point: We once had a hoarder client whose residence was filled to the brim with endless piles of junk – but there was more than met the eye. The decedent had randomly hidden cash inside items that appeared to be rubbish. Because of this, the Successor Trustee had to painstakingly go through each item in the house so as not to inadvertently throw away piles of money.

#7 Conduct an unclaimed property search on the California State Controller’s website.

According to California’s Unclaimed Property Law, corporations, businesses, associations, financial institutions, and insurance companies must report and deliver property annually to the State Controller’s Office after there has been no account activity or owner contact for at least three years. By running a quick search, you can find out if the decedent had any forgotten accounts.

If you have any questions about how to administer a trust or need assistance locating trust assets as a trustee, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.