How to Handle Estate Debts as a Trustee

In 2017, data revealed that 73% of Americans die with debt; the average debt balance (including mortgage debt) was $61,554. When a settlor of a revocable living trust dies, the job of dealing with estate debt and creditors falls to the successor trustee.

Your Duty as a Trustee

First, rest assured that as a trustee, you are not personally liable for estate debts. While creditors may make a claim on the estate or trust, if the estate is insolvent (unable to pay debts owed), you will not need to pay the debts out of your own pocket as long as you are observing your trustee duties.

There are a few exceptions to this rule. You could be held liable if you failed to pay a legitimately known estate debt and distributed trust assets to beneficiaries instead. Alternatively, if you paid an estate debt that really wasn’t necessary and reduced the beneficiaries’ share, they could sue you and seek reimbursement from you personally.

Paying creditors in an estate administration can become extremely complicated, and we strongly recommend seeking the counsel of an experienced trust attorney.

Common Estate Debts

Common debts that many trustees like you encounter include money owed to the government and both secured and unsecured debt. One essential step in every trust administration is sending notices to the California Franchise Tax Board, the IRS, and the California Department of Health Services, informing them of the decedent’s passing. Whenever a citizen dies, the government wants to know if they owed any taxes or Medi-Cal payback.

Other common types of debt include secured and unsecured debt. Secured debts are attached to collateral which the lender can seize, sell, and use to pay back the debt if the borrower defaults on payments. Real estate mortgages and car loans are examples of secured debt.

Unsecured debt lacks collateral, like credit card debt and student loan debt. As unsecured debt, they are lower priority creditors in an estate administration.

Which Debts Take Priority?

The estate must pay off debts in a specific order, starting with secured debt first.

California Probate Code Section 11420 lays out the order in which estate debts must be paid, which are summed up below:

- All expenses related to the estate administration.

- Obligations secured by a mortgage, deed of trust, or another lien.

- Funeral expenses.

- Medical expenses related to last illness.

- Family allowance (for family members who relied on the decedent for support).

- Wage claims (unpaid wages to any employees).

- All other debts, including unsecured debts.

How to Handle Estate Debts

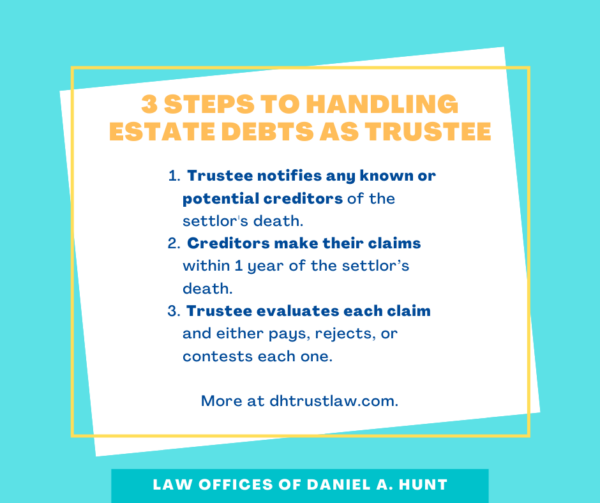

How do you handle estate debts as a trustee? There are 3 basic steps:

1. Trustee notifies creditors. As the trustee, notify any known or potential creditors that the person has passed away. In circumstances when the estate includes a business and/or a high potential of liability, you may want to file a proposed notice to creditors with the court as outlined in California Probate Code 19003.

2. Creditors make their claims. Creditors must follow the procedures outlined in California Probate Code Sections 9000 – 9399 to make a claim on the estate. They must determine how much is owed to them and submit their claim within one year after the settlor’s death. This time frame applies even if the creditor was unaware of the death.

3. Trustee approves, rejects, or disputes each claim. When a creditor submits a claim, the trustee must review decide whether it seems legitimate and accurate. California Probate Code section 19005 states, “The trustee may at any time pay, reject, or contest any claim against the deceased settlor or settle any claim by compromise, arbitration, or otherwise.” For claims that appear correct, you repay those debts using estate funds. For claims that appear fraudulent or incorrect, you can reject or contest the claim. If you reject it, the creditor has 90 days to file suit if they want to pursue the claim further.

Why You Need an Experienced Trust Attorney

Hiring a knowledgeable estate planning/trust lawyer is critical if the estate being administered has creditors and debts. The old saying “you don’t know what you don’t know” applies here. It can be difficult for a successor trustee to know which claims are legitimate and how to proceed in negotiating with creditors.

An experienced trust attorney will be able to advise you regarding which claims truly must be paid, how to negotiate the debts down and save the estate money, what to do if estate funds are insufficient to pay the debts, and much more.

Here’s an example to illustrate this point: A few years back, our law firm assisted with a trust administration where the decedent had significant debt. With skillful negotiation, our legal team successfully reduced the estate debt from $1.2 million down to $400,000, preserving a much greater sum for the beneficiaries. That’s the value of having a great trust attorney on your side!

If you have any questions about help or need help negotiating with creditors in an estate administration, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.