How to Get Reimbursed as Trustee

Picture this: A family member or friend has passed away. You know they created a Revocable Living Trust and named you as Successor Trustee in the trust document. They trusted you to handle their affairs when they died, and now the time has come to act as trustee.

But there’s a problem: you don’t have access to any trust assets yet! You probably haven’t received death certificates yet to prove to the bank that the decedent has passed. There’s a funeral to pay for, household bills that still need to be dealt with, and the Trust attorney requires a retainer. How should you handle this situation?

Our law firm handles dozens of Estate Administrations every year, and we’ve seen plenty of Successor Trustees in this challenging position. You’re not alone! Rest assured that expenses that directly benefit the trust estate are reimbursable. A common solution to the situation described is for you to pay the trust expenses upfront and then reimburse yourself after you gain access to trust assets.

Accounting for Reimbursements

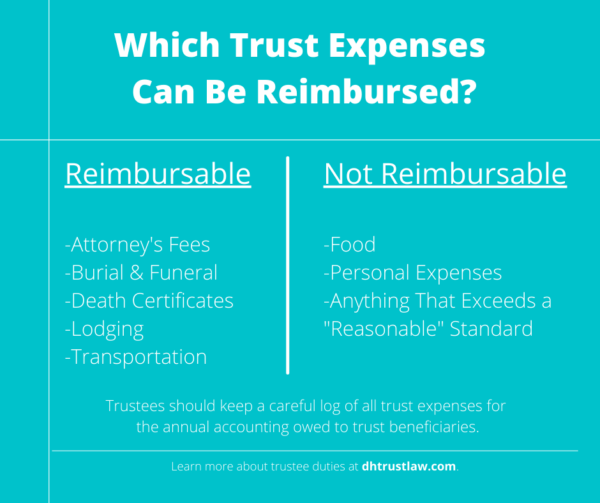

As Successor Trustee, it’s a good practice to keep a log and carefully track any expenses for which you seek reimbursement. All of these expenses will be reflected in the accounting you must provide to the trust beneficiaries on an annual basis.

Always keep in mind that the trust beneficiaries will view expenses as reducing their inheritance. There is a high probability that the beneficiaries will scrutinize any unnecessary or extravagant expenditures. Try to view all financial decisions through that lens to prevent any risk of future litigation. You may be personally liable for any expenditures that are deemed unnecessary or unreasonable.

Which Expenses Can be Reimbursed?

Reasonable expenses that directly benefit the trust estate can be reimbursed from trust funds. They include:

Attorney’s Fees: You’ll want to retain an experienced Trust attorney to guide you through the trust administration process. Any attorney’s fees incurred during the trust administration are reimbursable from the trust estate. (We don’t recommend administering a trust on your own.)

Death Certificates: The cost of obtaining death certificates from the county in which the decedent passed is reimbursable from the trust estate.

Burial & Funeral Expenses: This includes the cost of a coffin, embalming, cremation, funeral, etc. All of these costs are reimbursable from the trust estate.

Reasonable transportation: This might include gas for trust-related errands, bus/train fare, Uber/Lyft fees, a necessary flight to handle trust-related business, or a modest vehicle. It would not include buying yourself a new Mercedes-Benz.

Reasonable lodging accommodations: This might include a brief stay in a modest hotel to handle trust-related business. It would not include establishing a permanent residence at the Ritz-Carlton.

Which Expenses Cannot be Reimbursed?

Food: While you will likely need to eat while performing your trustee duties, that doesn’t mean that your meals are reimbursable from the trust estate. After all, even if you weren’t a trustee, you would need to feed yourself anyway. Don’t make the mistake of using trust funds to buy yourself food. The trust beneficiaries will not look kindly on an annual accounting riddled with Burger King and Chick-Fil-A charges.

Charges that are personal: Never use trust funds for personal expenses, even if you consider it a loan. Remember: loans to yourself from trust funds are a conflict of interest and a breach of your fiduciary duties.

Charges beyond a “reasonable” expense: As we discussed above, you will be personally liable for any expenses that go beyond what the beneficiaries will consider “reasonable”.

What if You Don’t Have Enough Money?

But wait – a funeral and an attorney’s fee retainer can cost thousands of dollars. What if you don’t have sufficient funds to personally cover these costs upfront?

Here you have a couple of options. If the decedent had a life insurance policy the funeral home may accept that as collateral to cover the burial and funeral expenses until you obtain access to the trust assets.

Some law firms may help you get started as Successor Trustee by meeting with you for a no-cost consultation. If you sign an agreement with them at that time promising to return with a retainer once you’ve accessed trust funds, they may provide you with a Certification of Trust so you can access trust accounts. Once you’ve obtained funds, you would need to compensate the firm for the work they performed and provide the retainer for the remaining trust administration work.

If you have any questions about how to reimburse yourself as trustee, feel free to contact our law firm. In our next post, we’ll be discussing trustee fees and explaining the rules of trustee compensation.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.