How to Communicate with Beneficiaries as Trustee

“My mother died a year ago. I still haven’t heard anything regarding the trust administration from my sister, the trustee. I never received a copy of the trust and I don’t know what’s going on! What can I do?”

We frequently hear queries like this from bewildered trust beneficiaries. Some have been kept in the dark for months or even years on a trust administration. Many of these beneficiaries choose to hire their own attorney and pursue legal action against the negligent trustee.

If you’re a trustee of a trust and you want to avoid being sued, you must learn how to appropriately communicate with the trust beneficiaries.

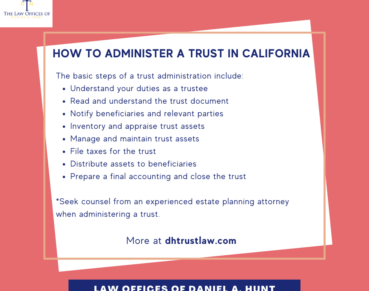

Duty to Communicate with Beneficiaries

As a trustee, you must always be careful to observe your trustee duties and avoid any perceived abuses of power. Under California Probate Code Section 16060, “The trustee has a duty to keep the beneficiaries of the trust reasonably informed of the trust and its administration.”

Notifying Beneficiaries of Trust Administration

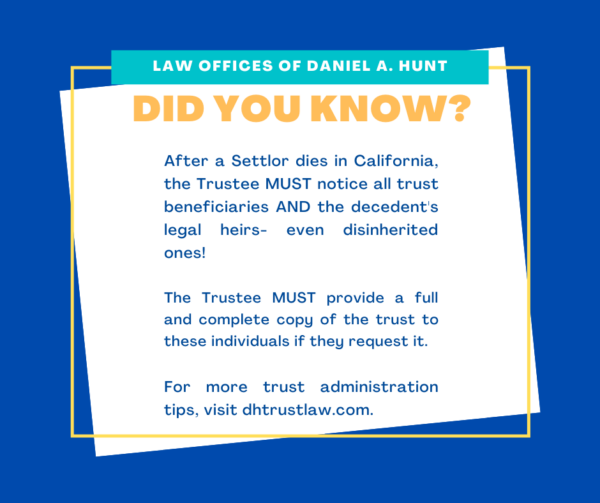

When a Settlor passes away, California Probate Code Section 16061.7 requires the trustee to notify the trust beneficiaries PLUS all the legal heirs (including disinherited ones) of the death. If you are working with a trust attorney, they will draft these letters on your behalf. These notices should be sent out within 60 days of the Settlor’s death.

The notices usually:

- Identify the trustee and provide contact information

- Inform recipients that they may request a complete copy of the trust document if desired

- Offer an approximate anticipated time frame for the process (without making any promises concerning asset distribution)

- Provide information on the statute of limitations on any trust contests

If you fail to provide these notices as trustee, the Probate Code states that you “shall be responsible for all damages, attorney’s fees, and costs caused by the failure unless the trustee makes a reasonably diligent effort to comply with that section”.

Keeping Beneficiaries Informed

Make an effort to keep the beneficiaries informed as the trust administration progresses. While it’s not necessary to inform them of every single detail, keeping them in the loop on major developments will help you earn their confidence. As with any relationship, consistent communication is the cornerstone of trust.

For example, if you’re handling a real estate sale, sending an email when an offer is received can let them know that things are moving along. If you experience delays in liquidating a certain account, a brief update helps keep beneficiaries from getting too antsy. When dealing with personal property, check in to see which items they would like to keep before selling or disposing of them.

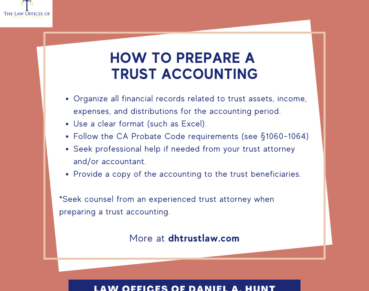

Accounting to Beneficiaries

The Probate Code also requires trustees to provide beneficiaries with an annual accounting and report of their actions and conduct in managing the trust assets. Your accounting must include trust income and income source; trust expenses; and any trust distributions and/or trustee compensation paid during that period. A trustee must keep careful records in order to be able to comply with this requirement.

Dealing with Difficult Beneficiaries

Communicating with beneficiaries can be challenging at times, especially when a beneficiary is aggressive, hostile, or verbally abusive. While you do have an obligation to keep each beneficiary informed of the trust administration process, you may opt to communicate with them in writing only. Hopefully, you are administering the trust under the guidance of an experienced trust attorney. If so, you can also choose to communicate with a hostile beneficiary only through your lawyer.

If you have questions about administering a trust or need assistance communicating with beneficiaries, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.