How Prop 19 Could Affect Your Estate Plan

Lately, we’ve had numerous clients calling us with questions regarding California’s Proposition 19 and how it could affect their estate plan. In order to understand the new changes under Prop 19, we first need to understand property tax.

What is a Property Tax?

Property tax is levied by the County Assessor’s office to the owner of real property. Your property tax basis is 1% of the purchase price. So if you purchase a home for $500,000, your property tax basis is $5,000 per year.

When Do Property Taxes Change?

There are three main ways for property tax rates to increase:

- Property taxes can be increased by the county to adjust for inflation every year. CA Proposition 13 (passed in 1978) limited these increases to no more than 2% per year.

- If you add improvements, property tax is reassessed as of the date of completion.

- When a piece of real estate changes hands due to sale, gifting, or death, the county generally reassesses (and increases) the property tax. However, there are exclusions to this general procedure.

Common Property Tax Exclusions

Here are types of transfers commonly excluded from property tax reassessment (and the resulting higher property tax bill):

- Spouses transferring either separate or community property to each other (including when one dies)

- Parent-to-child

- Grandparent-to-grandchild

- Seniors (over 55 years old) who are buying a home

What is Proposition 19?

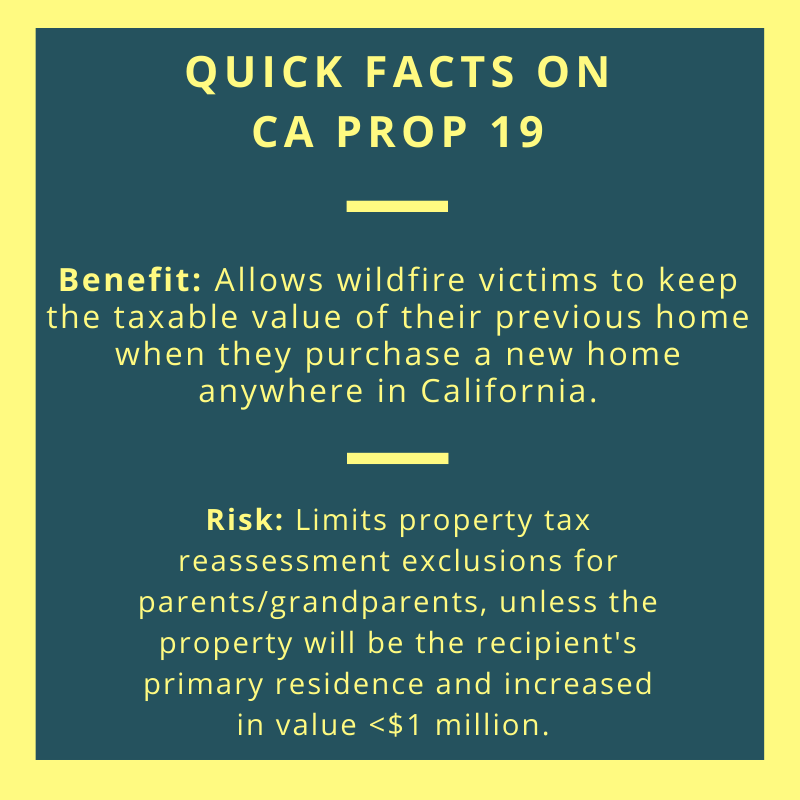

Proposition 19 was a ballot measure that was approved by 51.11% of California voters in November 2020. This measure creates county revenue by limiting parent-to-child transfers and dedicates that revenue to wildfire relief.

Here is the language of Prop 19, which has two main parts:

“Limit property tax increases on primary residences by removing unfair location restrictions on homeowners who are severely disabled, victims of wildfires or other natural disasters, or seniors over 55 years of age that need to move closer to family or medical care, downsize, find a home that better fits their needs, or replace a damaged home and limit damage from wildfires on homes through dedicated funding for fire protection and emergency response.

Limit property tax increases on family homes used as a primary residence by protecting the right of parents and grandparents to pass on their family home to their children and grandchildren for continued use as a primary residence, while eliminating unfair tax loopholes used by East Coast investors, celebrities, wealthy non-California residents, and trust fund heirs to avoid paying a fair share of property taxes on vacation homes, income properties, and beachfront rentals they own in California.” (CA. Const. Art. XIII A Sec. 2.1(a)(1-2))

Part I: Tax Benefits to Homeowners

Prop 19 expands the number of homeowners who can keep the taxable value of a previous home if they move to a new home, even if that property is situated in a different county within the State. If you are ever a victim of a wildfire or if you are over the age of 55 and wish to move to another county, this part of the new law could be beneficial to you.

Starting on April 21, 2021, Prop 19 expands the group of homeowners who qualify for a transfer of their taxable value from their current home to a new property. Currently, homeowners must be over the age of 55 or disabled in order to be able to move to a new home while keeping the same taxable value as their former residence. Now, wildfire victims will be able to enjoy this benefit too.

The old rules stated that the new home had to be in the same county as their old home, and the value of the new home had to be equal to or less than that of their new one. Under the new rules, you can move to any county in California. The value of the new home can be greater than the previous one as long as the increase in value is added to the transferred taxable value of the old home.

For example, 60-year-old Jacob Young owns a Sacramento home with a property tax value based on $400,000 and sells it for $500,000. He moves to San Diego to be closer to his grandchildren.

If Jacob buys a home that’s worth $500,000 or less, he can transfer his original property tax value on the $400,000 to his new home.

If Jacob upgrades to an $800,000 home, his new home’s taxable value will be $700,000: the taxable value of his old home transferred ($400,000) plus the $300,000 upgrade value ($800,000-500,000).

Part II: New Prop 19 Exclusion Rules

Starting February 16, 2021, parent-to-child and grandparent-to-child transfers will have a more limited exemption. Here are key points to know:

- Transfers to children or grandchildren that will be used as vacation rentals or investment property will be reassessed for property tax.

- Exclusions still apply for children/grandchildren who will use the home as a primary residence up to a value of $1 million.

- If the property value has increased by more than $1 million, a partial reassessment will occur. The $1 million threshold amount will be adjusted for inflation starting in 2023 and every year thereafter.

Potential Reassessment Solutions

If you’re concerned about your family members inheriting a property that will likely not be their principal residence, or if the property is an expensive home (worth over $1 million), you may wish to consult an experienced estate planner to discuss the ramifications of Prop 19 and find the best solution for your circumstances.

One possible solution could be to transfer the property to a child/grandchild prior to February 16, 2021. The disadvantage here is that you’ll lose your step-up in basis for Capital Gains tax purposes. Also, if you remain living in the house, the new property owner(s) will need to charge you rent.

Another option could be to create an irrevocable trust and transfer your real property into it. This would preserve your step-up in basis for Capital Gains tax benefits but entails a loss of control. Your chosen trustee would have complete control over any assets you place into the irrevocable trust.

If you have concerns or questions about how Prop 19 will affect your estate plan specifically, feel free to contact the Law Offices of Daniel A. Hunt. We’ll be happy to help you craft a solution that’s custom-fitted to your priorities and goals.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.