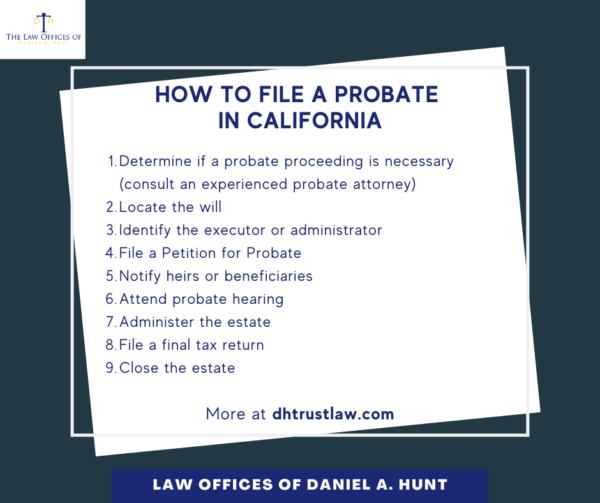

How to File a Probate in California

Filing a probate petition in California can seem like a daunting process, especially if you’ve never handled it before. Probate is the legal process through which a deceased person’s assets are distributed to their beneficiaries, and their debts are paid off. California has a structured system for probate, and knowing the steps involved can help ease the process. Here’s a step-by-step guide on how to file a probate in California.

1. Determine if Probate is Necessary

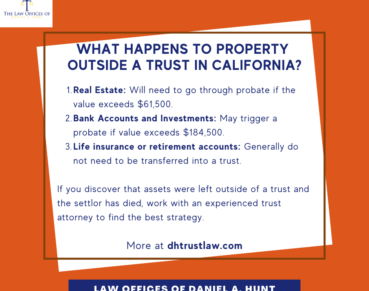

Not every estate needs to go through the Probate Court. In California, certain assets can bypass probate. These include:

- Property held in a living trust

- Jointly owned property with a right of survivorship

- Beneficiary-designated assets, such as life insurance or retirement accounts

Small estates may not require a full probate proceeding. If the total value of the deceased person’s estate is less than $184,500 (as of 2024), the estate may qualify for a simplified probate process called a small estate affidavit. Consult a probate attorney for help determining whether a probate is necessary.

2. Locate the Will

If the deceased left a will, the original document must be filed with the local court in the county where they lived within 30 days of death. The executor named in the will is responsible for filing the will with the probate court.

3. Identify the Executor or Administrator

The executor named in the will typically oversees the probate process. If no will exists, the proposed personal representative of the estate will petition the court to appoint an administrator to manage the estate. Executors or administrators have several duties, including collecting assets, paying debts, and distributing assets to beneficiaries upon court approval.

4. File a Petition for Probate

The executor or interested party must file a Petition for Probate (Form DE-111) with the Superior Court in the county where the deceased lived. Along with the petition, other forms and documents need to be filed, including:

- The original will (if available)

- Death certificate

- Acknowledgment of Duties and Liabilities

- Notice of Petition to Administer Estate (Form DE-121)

You’ll need to pay a filing fee, which is a fee set by the court at $435.

5. Notify Heirs and Beneficiaries

Once the petition is filed, the executor or administrator must notify all interested parties (heirs, beneficiaries, and creditors) of the probate proceedings. A Notice of Petition must be mailed to these individuals and published in a local newspaper as required by California law.

6. Attend the Probate Hearing

The court will schedule a hearing to officially appoint the executor or administrator. At this hearing, the judge will review the petition and any objections. If there are no disputes, the judge will approve the petition and issue Letters of Administration or Letters Testamentary, granting the executor the authority to manage the estate. Most courts will post calendar notes ahead of the hearing to advise of any deficiencies in the petition.

7. Administer the Estate

With the letters of authority, the executor or administrator can now:

- Collect and inventory the deceased’s assets, and such inventory must be filed with the court within 120 days.

- Notify creditors and pay any valid debts or taxes owed by the estate.

- Manage and safeguard estate property until it is distributed to the beneficiaries.

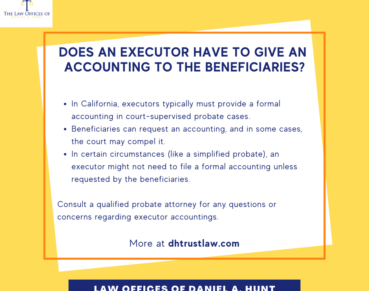

The executor must also provide an Accounting of the Estate to the court and the heirs, detailing all transactions made during the probate process.

8. Close the Estate

Once all debts are paid, and the assets are distributed according to the will (or California intestacy laws if there is no will), the executor can file a Petition for Distribution with the court. After the court reviews and approves the Petition and accounting, it will issue an order to distribute the remaining assets to the beneficiaries.

9. File a Final Tax Return

The estate must file a final income tax return (both federal and state) for the deceased and pay any applicable taxes. The executor may also need to handle estate taxes if the estate is large enough. In 2024, the estate tax only applies to very large estates, since the current estate tax exemption is $13.61 million per individual or $27.22 million per married couple.

Seek Legal Counsel

The California probate process can be quite complicated, involving many steps, forms, notices, petitions, and more. If conflict arises, the process becomes even more complex. The average California probate matter can take anywhere from 9-18 months or more to be completed, depending on the complexity of the estate and whether disputes arise.

While some estate administrators attempt to handle the process on their own, it’s best to seek legal counsel from an experienced probate attorney. They can help you navigate the process in the smoothest and most efficient manner possible.

If you have any questions about how to file a probate in California, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.