Estate Planning Gifting Strategies

When it comes to Estate Planning gifting strategies, we commonly hear questions like: Can you give away your estate to avoid Federal Estate taxes after your death? How much money can you give away to loved ones without incurring a gift tax? In this blog post, we’re going to explain what is considered a “gift” in California and how gift taxes work. We’ll also share common pitfalls and ways to avoid them with smart Estate Planning gifting strategies.

What Counts as a Gift in California?

California doesn’t enforce a gift tax, but the Federal government does. According to the IRS, the gift tax is “a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. The tax applies whether the donor intends the transfer to be a gift or not.”

Here are some examples of assets considered to be gifts when transferred to another person:

- Financial accounts such as bank, retirement, or brokerage funds

- Real property

- Assets like stocks and bonds

- Jewelry

- Vehicles

- No-interest or low-interest loans

Gifting as an Estate Planning Strategy

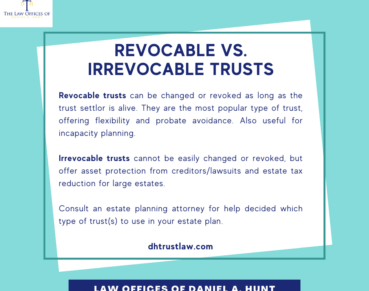

Some clients with large estates use a scheduled gifting estate planning strategy. By giving away their assets while they’re still alive, they intentionally reduce the size of their estate so as to limit or eliminate the estate tax that will be owed upon their death.

However, this must be done carefully and ideally in counsel with an experienced Estate Planning attorney and/or financial advisor to avoid incurring gift taxes.

Annual Gift Exclusion

In 2020, an individual can give away up to $15,000 tax-free to any number of people within a calendar year. A married couple could give away double that exemption amount for a total of $30,000 to one person in a given year.

For example, if you’re married with children, you and your spouse could give one child up to $30,000 total ($15,000 from each spouse) tax-free in a given year.

Gifts of this amount or lower do not have to be reported, although you should keep records of the gifts. If you exceed that amount, you must file a gift tax return. You can give that amount of money to as many people as you’d like without it counting against your lifetime estate tax exemption.

Lifetime Gift Exclusion

A lifetime gift exclusion exists for large gifts In 2020, the lifetime exclusion amount is $11.58 million. That is the total amount you are permitted to give away in your lifetime without incurring a gift tax.

Once the entire lifetime gift amount is exceeded, any future gifts of more than $15,000 a year to any one person will trigger a gift tax. Gift tax ranges from 18% to 40% and is paid by the giver; recipients do not usually get taxed.

Gift Tax Exemptions

Here are some of the individuals and entities you can give as much as you want to without triggering a gift tax. These gifts won’t reduce your lifetime gift and estate tax exemption

Spouse: As long as your spouse is a U.S. citizen, you can transfer any amount of cash and property to them tax-free. If your spouse is not, the IRS sets an annual limit to what you can give tax-free. For tax year 2019 (what you’d file for in 2020), that limit is $155,000. For tax year 2020, the figure moves to $157,000.

Medical Institution: If you pay the bill for someone else’s qualified medical expenses, it may be non-taxable if you send payment directly to the institution. Counsel with a tax professional if you would like to do this.

Charity: If you donate to a registered non-profit organization, the IRS may not treat it as a taxable gift. Confirm with a tax professional or financial advisor that your desired organization qualifies for this exemption.

Educational Institution: Paying for a child’s tuition won’t cut into your gift-tax lifetime exclusion as long as you send the payment directly to the school (NOT the student). Keep in mind this applies to tuition only. For other educational expenses such as books, read on to learn about the 529 Plan Gift Tax Exemption.

529 Plan Gift Tax Exemption: A 529 plan is “a tax-advantaged savings plan designed to encourage saving for future education costs”. These plans enjoy their own tax breaks including a special gift tax exemption.

You can contribute up to $75,000 toward a 529 plan without reducing your lifetime gift and estate tax exemption. The only caveat is: you can’t make any more contributions toward the plan with the same beneficiary for the next five years.

Essentially, the IRS is letting you use five of your annual gift tax exclusions for one individual at once ($15,000 x 5 = $75,000). Otherwise, your contributions would be prorated. So if you only contributed $30,000 in one year ($15,000 x 2), you would need to wait two years to make any additional contributions to that plan.

5 Estate Planning Gifting Pitfalls

If you’re not careful, you could inadvertently make a “gift” and incur a gift tax, or incur other taxes that could have been avoided. Here are 5 gifting pitfalls to avoid.

#1 Gifting highly appreciated assets while you’re still alive. This gifting pitfall has to do with Capital Gains tax. Sometimes clients are tempted to give a highly appreciated asset to a child, like a family cabin or an investment home. Here’s the problem: when the child sells that property, they will have to pay Capital Gains tax on the appreciated value.

Here’s a better approach: waiting to distribute that property to your heirs under your Trust when you die. With this strategy, your heirs will receive a step-up in basis when they sell it, saving them a lot of money in taxes. So we recommend that you consider waiting until you pass to give away highly appreciated assets.

#2: Paying for an expensive vacation, wedding, etc. You may not be thinking that giving your son money for his honeymoon vacation will count as a gift. But if you’re giving him more than $15,000, the IRS will consider it to be a gift. Instead of giving money to another person for a large purchase, pay for it directly.

#3: Giving a loved one an interest-free loan. Again, in the eyes of the IRS, this is considered a gift and taxes will be owed. A better solution is to secure the loan with a Promissory Note with expected interest and payments.

#4: Adding a family member to a joint bank account. You may have the best of intentions when adding your daughter as a joint owner on your bank account. You might think it’s a matter of convenience, so she can assist you in paying bills. But be cautious – if the joint owner you add takes out any amount of money from the account beyond what they put in for their own use, it will be treated as a gift.

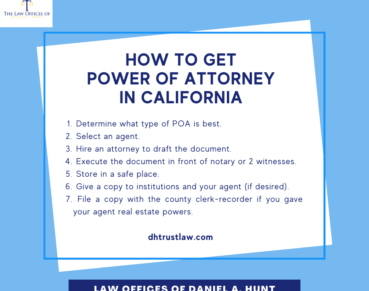

A better option might be to draft a Durable Power of Attorney that will allow an agent to access your bank accounts if needed. Reminder for clients with a Revocable Living Trust: bank accounts should generally always be held in the name of your Trust.

#5: Giving a cash gift to help a loved one pay educational expenses. Instead of gifting $50,000 directly to your grandkids for college tuition or supplies, make tuition payments directly to the institution or contribute that money to a 529 Plan (as outlined above).

We hope this information has helped you develop some smart Estate Planning strategies. If you have any questions about gifting, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.