Debunking 5 Estate Planning Myths

As an Estate Planner, I’ve heard my fair share of Estate Planning misconceptions over the years. In this blog post, I’m going to debunk 5 common Estate Planning myths so you don’t make a costly mistake.

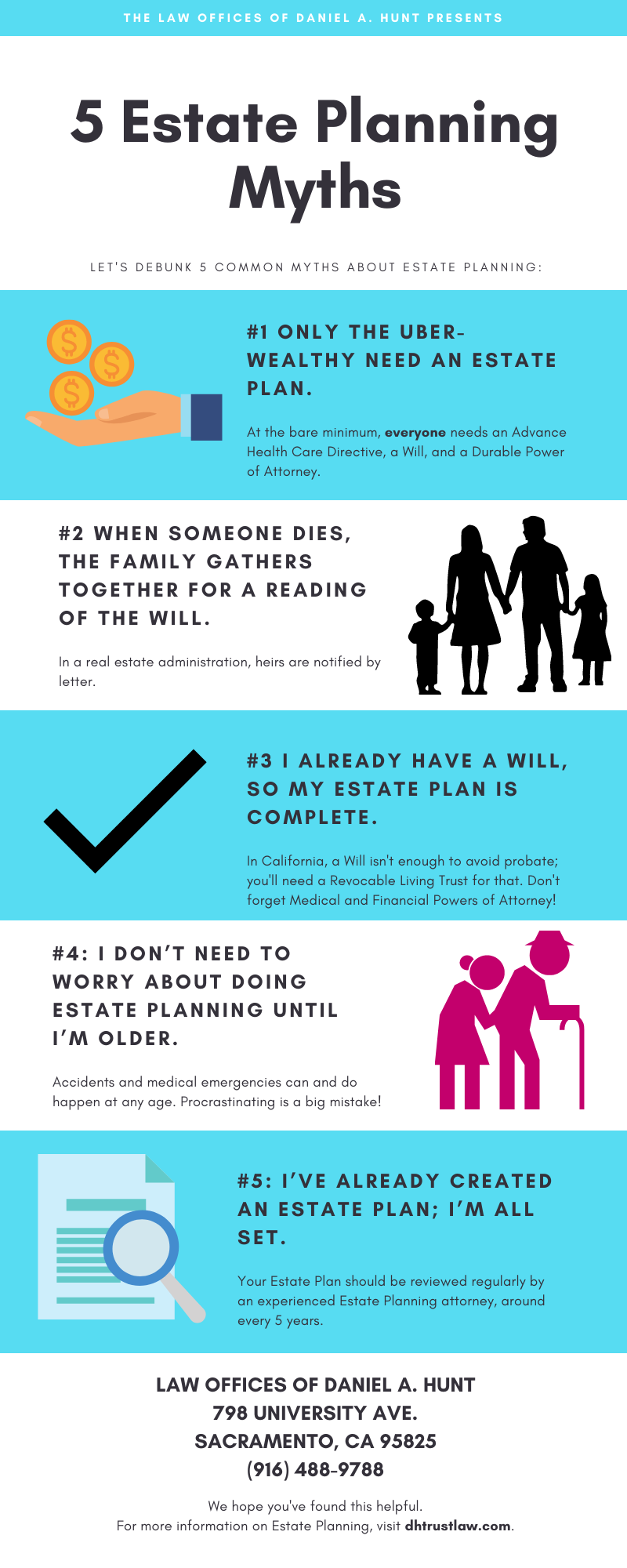

Myth #1: Only the uber-wealthy need an Estate Plan.

One common misconception is that only the wealthy need to create an Estate Plan. Perhaps this myth arises from watching BBC Channel period piece films. The word “estate” may conjure up images of elite aristocratic families battling over who will inherit formidable “family estates” and massive country manors.

Few Californians have a country manor to leave to their family members, but guess what? Modern-day Estate Planning is literally for everyone! Here’s the truth about Estate Planning in California in 2020:

Everyone needs these 3 legal documents: an Advance Healthcare Directive, a Will, and a Durable Power of Attorney.

If all of your assets, including real estate, are worth more than $166,250, you should consider creating a Living Trust. If you don’t do this, your loved ones will likely be facing a lengthy and costly probate when you pass away. Placing your assets in the trust will help you avoid probate.

Here’s another reason why Estate Planning isn’t just helpful for the wealthy. Estate Planning isn’t only about distributing your assets after you die; it’s also about incapacity planning. That’s why every adult needs to create an Advance Healthcare Directive and a Durable Power of Attorney too.

Myth #2: When someone dies, the family gathers together for a reading of the Will.

Ah, the reading of the Will! A classic Hollywood staple. The family Will reading scene often leads to dramatic revelations and plot development in many movies, but it isn’t something that happens in real life.

Here’s a more realistic scenario: After a person passes away, their Successor Trustee/Executor meets privately with an Estate Planning/Trust/Probate attorney. The attorney coaches them through the process of administering the deceased person’s estate. The attorney will notify the heirs of the estate administration by mail. Instead of a dramatic Will reading, heirs find out if they will be receiving an inheritance by letter.

Estate Planning still has occasional drama, but it plays out much differently than you see in the movies.

Myth #3: I already have a Will, so my Estate Plan is complete.

In other states, this may be true – but not in California. Remember, creating a simple Will allows you to select an executor and outline how you want your assets to be distributed when you pass away. However, if you only have a Will, your estate will still need to go through the probate process.

California Probate Courts are so clogged with cases that estate heirs will likely be waiting at least a year or even longer to receive their inheritance. Probate is generally more expensive than creating a Living Trust. That’s why most Californians use BOTH a Pour-Over Will AND a Revocable Living Trust in their Estate Plan.

And don’t forget that Medical and Financial Powers of Attorney (aka Advance Healthcare Directive and Durable Power of Attorney) are also part of a complete Estate Plan.

While a Will is a good start, you probably should not rely on a Will alone for your Estate Plan.

Myth #4: I don’t need to worry about doing Estate Planning until I’m older.

It’s true that older adults are statistically the most likely to have an Estate Plan in place. A Caring.com 2020 survey found that adults over the age of 55 were the most likely to have an Estate Plan at 47.9%.

However, this doesn’t mean it’s wise to procrastinate creating an Estate Plan until your golden years. Accidents and medical emergencies can and do happen at any age.

Case in point: In the infamous Terri Schiavo case, a 26-year-old woman entered into a permanent coma after experiencing cardiac arrest. Her husband felt she would want to be removed from life support; her parents felt she would want to remain on life support indefinitely.

Unfortunately, Terri had no Estate Planning documents in place indicating her wishes. She remained alive in a vegetative state for 15 years while her husband and parents fought in court over her fate. The court finally ruled to remove her from life support, but think of the monetary and emotional cost of 15 years of medical and legal expenses.

Things could have gone differently for the Schiavo family if Terri had planned ahead while she still had the physical and mental capacity to do so.

Myth #5: I’ve already created an Estate Plan; I’m all set.

Estate Planning is not a “one and done” situation. After you set up your Estate Plan, you will want to review it regularly to ensure it still matches your desires.

If you divorce, your spouse or your Successor Trustee/Executor/Agent dies, or your children become legal adults, you may want to consider updating your Estate Plan to reflect those changes.

Over the years, a lot can also change when it comes to Estate Planning law. We contact our clients annually to inform you of key law changes that may affect your estate plan. We recommend having your Estate Plan reviewed every 5 years by an experienced Estate Planning attorney.

So that’s it – 5 common Estate Planning myths, debunked! If you have any questions, feel free to contact our law firm to schedule a consultation.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.