Can a Trust Hide Your Identity & Assets?

One frequently asked question we hear from new Estate Planning clients is: Can I use a trust to hide my identity or assets?

Why Hide Your Identity or Assets?

First, you may be wondering: Why would someone want to hide their identity or assets?

Let’s talk about identity first. We all value our privacy, but clients who have a certain degree of fame feel even more compelled to preserve privacy. This can be especially relevant when purchasing real estate. Why?

- Celebrity home buyers may wish to remain anonymous to avoid being gouged on the price of real estate.

- For well-known clients, security poses a concern when it comes to public records. An actor, politician, or musician may feel uncomfortable with the idea that the general public could identify their home address with a simple title search. They often wish to protect their home from enthusiastic fans or dangerous detractors.

As far as hiding assets, celebrities also tend to have larger estates to protect and may want to hide assets from predators.

How to Hide Your Identity/Assets

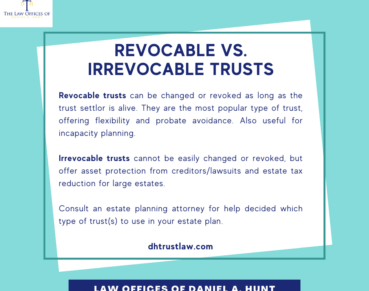

Now let’s talk about how you can use revocable and irrevocable trusts to protect your privacy.

REVOCABLE LIVING TRUST

We discussed the difference between revocable and irrevocable trusts in this previous post. As we shared there, Revocable Living Trusts are popular in California due to their flexibility. But can they be used to hide your identity and assets? It’s not impossible, but it is a bit tricky.

NAMING THE TRUST DIFFERENTLY

One way to protect your privacy is to name your Revocable Living Trust something generic instead of your actual name. Most Californians use their own name when naming their Revocable Trust. For example, John Smith and Sally Smith might name their trust, “The John Smith and Sally Smith 2020 Revocable Living Trust,” or simply “The Smith Family Trust”.

After the Smiths transfer their assets, like bank accounts and real estate, into their trust, the asset titles will include the name of the trust. For example, “John and Sally Smith, as trustees of the Smith Family Trust”.

But did you know that you can name your Revocable Living Trust anything you want? If you wanted to hide your identity, you could name your trust something other than your real name. We have seen some creative trust names over the years. One client named his trust after a certain beet farmer on the popular tv sitcom “The Office”.

DRAWBACKS

Keep in mind, the asset titles also have the trustee’s name in them. In order to use this method to hide your identity, you would need to use a generic trust name AND name a trustee other than yourself. Most people want to remain in control of their assets while they’re still alive, so that’s a drawback.

Here’s another drawback: A Revocable Living Trust doesn’t provide asset protection from lawsuits or creditors. Here’s a good rule of thumb: If the assets are still accessible to you, they’re still accessible to predators. If asset protection a primary concern, you might consider another approach.

IRREVOCABLE TRUST

Another method to protect your privacy would be to use an irrevocable living trust. An irrevocable trust is harder to change once established, but it can be used to protect both your identity and your assets from future creditors and lawsuits.

WHICH TRUST TYPE TO USE?

There are many kinds of irrevocable trusts: Special Needs Trusts, Life Insurance Trusts, Intentionally Defective Grantor Trusts (IDGTs), and more. If one of these types of trusts matches your other Estate Planning goals, they could also be used to protect your identity and assets.

Here’s an example of how this could work: You might create a Special Needs Trust for a disabled child named Susan, name the trust after her (ie, “The Susan Smith Special Needs Trust”), and transfer a piece of real estate into the trust. No one looking at the real property title would associate your name with ownership of that property.

DRAWBACKS

Three potential drawbacks to using an irrevocable trust to mask your identity are:

- They’re difficult to change.

- You’ll need to give up control of the assets in the irrevocable trust to your named trustee who will manage the assets and pay taxes on them.

- This strategy can backfire if your chosen trustee lacks integrity.

Case in point for #3: Our firm represented a certain musician who had a #1 hit in the US in the 90s. Because of his fame, he had placed real estate in an Intentionally Defective Grantor Trust (IDGT) to protect his identity. Later, he discovered that the trustee he’d named was stealing rental income from his properties and trying to sell the parcels without his permission. He hired our firm to represent him in the litigated battle that ensued.

Moral of the story: Be very careful to choose a trustworthy trustee to manage an irrevocable trust!

If you have any questions about this topic or for legal advice on protecting your privacy, feel free to contact our law firm to schedule a consultation with an Estate Planning attorney to find out which type of trust will best meet your objectives.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.