How to Administer a Trust in California: A Step-by-Step Guide

Administering a trust in California can seem daunting, especially if you’re new to the responsibilities of being a successor trustee. However, by understanding the key steps involved and knowing the California-specific rules, you can carry out your duties smoothly, efficiently, and legally. Here is a step-by-step guide detailing how to administer a trust in California.

Step 1: Understand Your Duties as a Trustee

The first responsibility of any trustee is to fully understand their role. As a trustee, you have a fiduciary duty under the California Probate Code, which means you are legally obligated to act in the best interest of the trust and its beneficiaries. This includes managing trust assets responsibly, making prudent financial decisions, and distributing assets according to the terms of the trust.

Failing to uphold these duties could result in legal consequences. As a trustee, you need to be fair, transparent, and diligent in all your actions related to the trust.

Step 2: Read and Understand the Trust Document

The trust document is your guide to administering the trust. It outlines the rules, distributions, and intentions of the person who created the trust, known as the “grantor” or “settlor.” Reviewing this document carefully helps ensure you understand the specific instructions for asset distribution, timelines, and any other special provisions.

If you’re unsure about any part of the trust document or your role as trustee, it’s wise to consult an experienced estate attorney who can help you understand your duties and clarify any ambiguous terms.

Step 3: Notify Beneficiaries and Relevant Parties

California law requires trustees to formally notify all beneficiaries and heirs about the trust and its administration. This notification, often referred to as a “Notice of Irrevocability,” informs beneficiaries that the trust has become irrevocable due to the settlor’s death, if applicable. Beneficiaries then have a statutory period of 120 days to contest the trust if they believe it was established under undue influence or fraudulent circumstances.

Timely notification is critical, as failing to meet this step can lead to legal issues and may expose the trustee to liability.

Step 4: Inventory and Appraise Trust Assets

Once you’ve notified beneficiaries, the next step is to inventory and appraise all assets within the trust. This includes real property, stocks, bank accounts, personal property, and any other assets held in the trust’s name. It’s essential to get a professional appraisal for major assets, like real estate or valuable collections, to establish an accurate valuation.

This detailed inventory serves as a foundation for all distributions and helps you understand the full value of the trust before making any decisions.

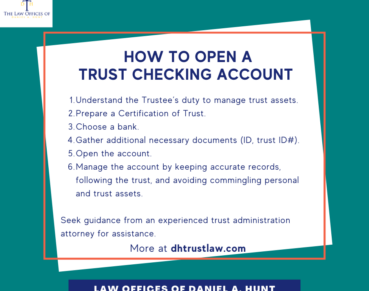

Step 5: Manage and Maintain Trust Assets

As a trustee, you’re responsible for managing the trust’s assets until they’re distributed to the beneficiaries. In some cases, this means you may need to maintain a home, manage investments, or keep funds in an interest-bearing account. California law requires that trustees act prudently and avoid risky investments that could jeopardize the trust’s value.

In addition to managing assets, you’ll also need to handle any expenses, taxes, and debts associated with the trust. Trustees can often hire professionals, like financial advisors or accountants, to help with these duties, especially if the trust is complex or has significant assets.

Step 6: File Taxes for the Trust

Trusts are separate tax entities, and it’s the trustee’s responsibility to file income tax returns on behalf of the trust. California requires that trustees file state and federal tax returns for any income generated by the trust assets. Failure to do so can lead to penalties and additional fees, so make sure to consult with an accountant to avoid any issues.

Depending on the trust’s setup, beneficiaries may also owe taxes on their distributions, so it’s wise to work with a tax professional who understands trust taxation.

Step 7: Distribute Assets to Beneficiaries

Once all debts, expenses, and taxes have been paid, you can begin distributing the remaining assets to the beneficiaries as outlined in the trust document. Keep in mind that each distribution should be documented carefully to maintain transparency and comply with California’s record-keeping requirements.

The trust administration process requires careful planning, especially if the trust includes complex distributions (like staggered payouts or beneficiary conditions). Consulting an estate planning attorney can help ensure that all distributions are completed legally and as intended by the settlor.

Step 8: Prepare a Final Accounting

In California, trustees are required to provide a detailed accounting of all trust activities, including all income, expenses, and distributions. This final accounting should be presented to beneficiaries, who have the right to review and question any part of the trustee’s administration. Providing a clear, accurate final accounting helps establish transparency and minimizes the risk of disputes.

Step 9: Close the Trust

Once all assets are distributed and the final accounting is approved, you can proceed with closing the trust. Closing a trust involves distributing trust assets, paying any final expenses, and filing any remaining tax returns. Afterward, you’ll send the beneficiaries a final release and ask them to sign the document, signaling that all responsibilities have been fulfilled and releasing you from your fiduciary duties.

Seek Legal Counsel

Administering a trust in California requires patience, diligence, and a keen understanding of both the trust’s terms and California law. Many trustees find it helpful to work with professionals—such as attorneys, accountants, and financial advisors—to ensure that they meet all legal and fiduciary responsibilities.

If you’re a new trustee or facing a particularly complex trust, consider consulting an experienced trust attorney. An attorney can help you navigate trust administration, meet your fiduciary duties, avoid litigation, and ultimately ensure that the trust is administered effectively and as intended.

If you have any questions about how to administer a trust in California, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.