What Happens If You Don’t File a Probate in California?

Probate is a legal process that occurs after someone passes away, involving the administration of their estate and the distribution of assets to the heirs or beneficiaries. Failing to file for probate can have significant consequences for both the deceased person’s estate and their heirs. What happens if you don’t file a probate in California? Here are some of the potential ramifications of not filing for probate in California.

Property Distribution Issues

One of the primary purposes of probate is to ensure a fair and orderly distribution of the deceased person’s assets to their beneficiaries or heirs. Since some property and assets cannot be transferred without going through probate first, assets may be frozen and inaccessible to the heirs.

On the relational side, the distribution of property may become chaotic and contentious. Without a court-supervised process, there’s a risk of disputes among potential heirs, potentially leading to prolonged legal battles and strained family relationships.

Confusion with Creditors’ Claims

Probate serves as a mechanism for addressing the deceased person’s outstanding debts and liabilities. Failing to file for probate in California means that creditors may not receive legal notices that start the statute of limitations running for them to make a claim. That means creditors could potentially come after the estate years later.

Since the estate is responsible for resolving outstanding debts, it’s much better to send the appropriate notices, run the statute of limitations, and negotiate and resolve debts so the estate assets can be distributed to heirs in a timely manner.

Inability to Transfer Real Estate

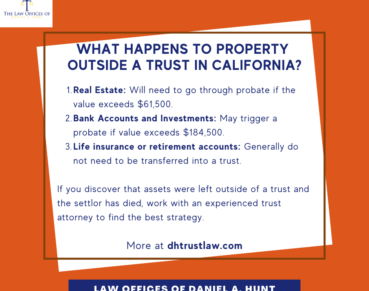

The most valuable asset in many California estates is real property. In most cases where the decedent didn’t create an estate plan or only created a will, a formal probate proceeding is required to transfer ownership of real estate.

If you don’t file for probate, the transfer of real estate can become complicated. The lack of a court order can make it challenging to sell or transfer property title, leading to a clouded title that may affect its value.

Delay in Resolving the Estate

Probate provides a structured timeline for settling an estate, helping to expedite the process and bring closure to the heirs. By avoiding probate, the resolution of the estate may be significantly delayed. Heirs may face uncertainty about their inheritances, and the entire process could stretch out for years.

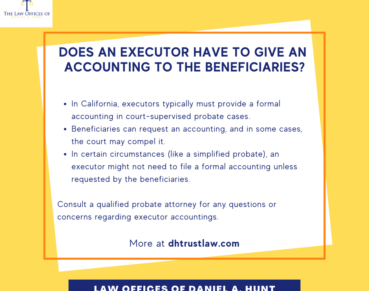

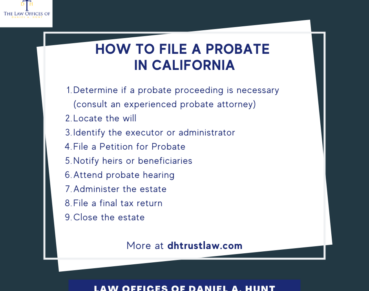

Removal of Executor

If the decedent created a will and named an executor, this person is responsible for filing a petition for probate, managing the assets, and distributing them to the named beneficiaries. If more than 60 days have passed since the date of the decedent’s death and the executor has still not filed a petition for probate with the court, then the executor can be removed from their position and another person may take their place.

The process of removing and replacing an executor further delays the already lengthy probate process. If you’ve been named as executor, it’s crucial that you initiate the probate process in a timely manner if you wish to stay in that role.

Legal Complications

Probate provides a legal framework for resolving disputes, validating the deceased person’s will, and ensuring that all legal requirements are met. If you try to skip the probate process, you may encounter legal complications, as the lack of oversight can give rise to challenges regarding the validity of the will or rightful heirs. This could potentially open the gate to expensive and lengthy legal disputes and estate litigation.

The best way to avoid conflict is to seek legal counsel early and often when administering an estate.

Alternatives to Probate

If the estate in question is very small, you may be able to use one of the simplified procedures that California offers for transferring property instead of a full probate court proceeding.

If the decedent’s personal property is worth $184,500 or less, a relative can collect it and distribute it to the heirs by using a Small Estate Affidavit. At least 40 days must have passed since the decedent passed away. If a probate case has already been opened, you would need written permission from the estate’s executor or personal representative to use a Small Estate Affidavit.

If the decedent owns California real estate worth $61,500 or less (such as a plot of bare land), they may be able to transfer this property by using a California Judicial Council Form DE-305, or Affidavit Re: Real Property of Small Value.

If you think you may be able to use one of these simplified procedures and skip a full probate proceeding, you should consult an experienced California probate attorney.

Seek Legal Counsel

While the probate process in California may seem daunting, avoiding it can lead to more significant challenges and complications. Failing to file for probate can result in disputes among heirs, legal complexities, difficulties in property transfer, and delays in settling the estate.

To ensure a smooth and orderly distribution of assets, seek legal guidance from an experienced probate attorney and initiate the probate process promptly. Taking these steps can help protect the interests of all parties involved and provide the most efficient resolution to the deceased person’s affairs.

If you have any questions about this topic, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.