What Are Children’s Rights After Their Parents’ Death?

If you recently lost your parents, you may be grieving while also wondering what your rights are regarding California inheritance laws. What are children’s rights after their parent’s death? Here’s an overview to help you navigate this situation.

What Are Children’s Rights After Parents’ Death?

When parents pass away leaving multiple children behind, what each child inherits depends on several factors, including:

- Whether the deceased parent created an estate plan, such as a trust or will.

- Whether the deceased parent left behind a surviving spouse.

- California inheritance laws.

The first question to ask is whether the decedent created an estate plan.

Children’s Rights Under an Estate Plan

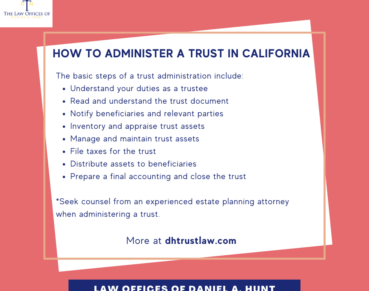

If your parents die and they created an estate plan, like a revocable living trust or last will and testament, that document will dictate who will inherit their estate, how much is received by whom, when it is received, and who will handle the trust or estate administration.

Parents can design their estate plan distribution however they desire and are under no obligation to leave an inheritance to any one. They can also change their mind to amend their trust or will up until the time of their death, so long as they are of a “sound mind” and have the mental capacity to do so.

Some common trust distributions for parents with children include:

- The estate assets are split equally between the children.

- One child who already lives in the house is allowed to inherit the house and continue living there, while the other siblings receive the remaining estate assets.

- Some children receive an inheritance while others are disinherited. Parents are more likely to disinherit children who were estranged from the parents for some time before their death or who do not have as great a financial need for the inheritance as the other siblings.

These are just a few examples, but the variations are endless. Keep in mind that if the deceased parent has remarried and leaves behind a spouse, their estate plan may look different. Children may receive nothing during the surviving spouse’s lifetime but may still inherit after the surviving spouse’s death if any assets remain. Review a copy of the decedent’s estate plan and seek the counsel of an experienced estate planning attorney for advice tailored to your specific circumstances.

Children’s Rights Without an Estate Plan

What if your parents died without any estate plan in place? This is called “dying intestate” and in this circumstance, the estate will be distributed according to “intestate succession”. Intestate succession is the process of distributing estate assets to your closest living relatives when an individual dies without a will, or when all of the beneficiaries listed in the will have already passed away. The rules for intestate succession are found in the California Probate Code.

Rules of Intestate Succession

The rules of intestate succession are complicated, but here are a few examples of how California intestacy laws would distribute your deceased parents’ assets.

- If the parent died with no spouse but children, the children inherit everything.

- If the parent died with a spouse and one child or grandchild, the surviving spouse inherits all community property and 1/2 of the decedent’s separate property. The child or grandchild inherits the remaining 1/2 of the decedent’s separate property.

- If the parent dies with a spouse and two or more children, the surviving spouse inherits all of the decedent’s community property plus 1/3 of the separate property; the children inherit the other 2/3 of the separate property

What Assets Are Excluded From Intestate Succession?

Intestacy laws only apply to assets that would have been disposed of by a trust or will if one existed. Property that would be excluded includes:

- Any property you’ve transferred into a revocable living trust

- Life insurance proceeds with a named beneficiary

- Retirement accounts (IRAs, 401(k)s, etc.) with a named beneficiary

- Any transfer on death or payable on death accounts or assets

- Property you hold in joint tenancy with another person

Who is Considered a Child?

You may be wondering who qualifies as a child under intestate succession in California, and the California Probate Code outlines these rules. The following categories of relationships are considered children and are entitled to a share of your estate if the decedent died intestate:

- Children born to your wife or registered domestic partner during your marriage.

- Adopted children (children you legally adopted).

- Posthumous children (children conceived by you and born after your death, or conceived with your generical material within two years of your death).

By contrast, the following categories of relationships are not automatically entitled to inherit a share of your estate:

- Children you placed for adoption.

- Children born outside of your marriage or a registered domestic partnership. In order to inherit, they’d need to prove that you acknowledged them as your child and contributed to their care and support.

- Grandchildren. A grandchild would not receive a share unless their parent (your child) had already passed away.

- Foster children and stepchildren. These individuals would only inherit if they could prove that their relationship with the decedent began while they were a minor and continued throughout their lifetimes, and that the decedent would have adopted the child if it had been legally possible.

As you can see, there are unlimited variations on children’s rights after your parents’ death. Consult with an experienced trust and estate lawyer if you have any questions about this topic.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.