How Long Can a Trust Remain Open After Death?

One common question that trustees or trust beneficiaries may have is: How long can a trust remain open after death? Many factors can affect the length of time a trust can remain open after a settlor passes away, but here’s an overview.

Rule of Perpetuities

In common law, the Rule of Perpetuities states that nothing can last forever. According to this rule, a trust can remain open up to 21 years after the death of the last person who was alive at the time the trust was made. This rule is very vague and most trusts do not stay open as long as they potentially could under the Rule of Perpetuities.

Typical Trust Administration

The most popular type of trust is a revocable living trust, and most of these trusts are closed within 6-12 months of the settlor’s death. Efficiently completing a trust administration has two main advantages:

#1: It preserves time and money: If a trust administration lasts longer than a year, the trustee must provide beneficiaries with an annual accounting of all their actions. This takes time and costs money. The trustee may also take an annual trustee fee, which could drain the trust assets. To avoid the appearance of negligence, most trustees strive to complete the administration as quickly as possible.

#2: It reduces the risk of the trustee getting sued: The longer the trustee takes to complete the trust administration, the higher the risk of beneficiaries losing patience waiting for their inheritance and suing the trustee for negligence.

Notable Exceptions

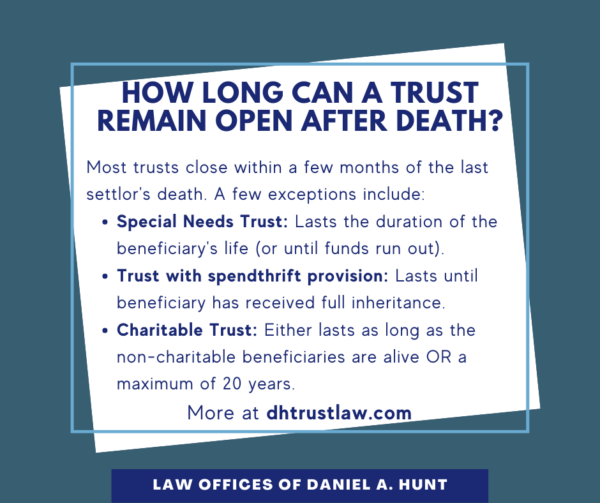

There are a few exceptions in which a trust stays open longer than average. Here are three types of trusts that may remain open for long after the settlor’s death:

- Special Needs Trust: If the settlors created a Special Needs Trust to benefit a disabled beneficiary, this trust will be managed by a trustee for the disabled beneficiary’s care as long as that beneficiary is alive and there are funds left in the trust.

- Trust with a Spendthrift Clause: Some settlors insert a spendthrift clause into their trust when they wish to leave an inheritance to a financially irresponsible beneficiary. Under this type of distribution, the beneficiary would receive a set amount of money every year after the settlor’s death instead of one lump sum. This arrangement would cause the trust to remain open as long as there is still money left to distribute.

- Charitable Trusts: With a Charitable Remainder Trust, you can name yourself or someone else to receive a potential income stream for a set number of years (not to exceed 20), or for the life of your non-charitable beneficiaries. After that, the remainder of the donated assets will be distributed to one or more charities of your choice.

How to Handle Trustee Negligence

What can you do if these exceptions don’t apply and a trustee of a revocable trust is dragging their feet to finish administering a trust? Trust beneficiaries in this situation may consider seeking an experienced trust litigation attorney to represent their interests. Knowing that a beneficiary has retained legal counsel can help motivate a sluggish trustee to carry out the settlor’s wishes in a more efficient manner.

If you have any questions about how long a trust can remain open after death, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.