How to Close a Probate Estate

As an estate administration nears completion, it’s critical for the Personal Representative to understand how to close a probate estate. The Personal Representative must complete specific steps to close the probate estate, including filing a Final Account, Report, and Petition for Final Distribution; setting the petition for hearing; giving notice of the hearing; and obtaining a court order approving the final distribution.

Filing a Final Account and Petition for Distribution

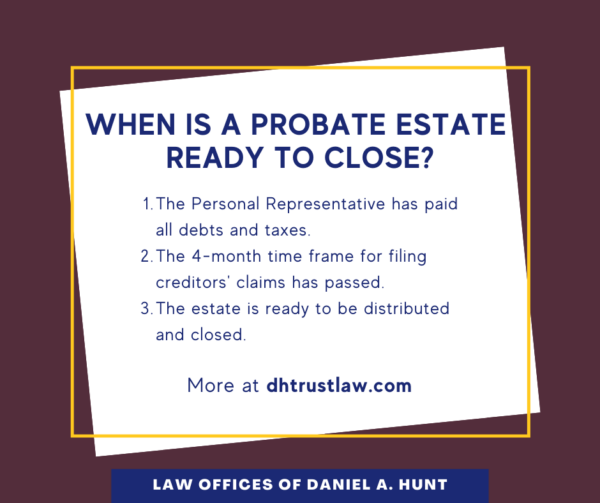

As the Personal Representative, you can file a Final Account, Report, and Petition for Distribution when:

- You’ve paid all debts and taxes

- The 4-month time frame for filing creditors’ claims has passed

- The estate is ready to be distributed and closed.

Ideally, you should be ready to file this petition within one year of receiving Letters of Administration (or 18 months if you need to file a federal estate tax return). If the estate cannot meet this deadline, you must file a report on the status of the estate instead. An experienced probate lawyer can help you file the necessary paperwork and meet all of your deadlines.

The Petition for Final Distribution is prepared in legal pleading format. It generally includes three parts:

- An accounting (unless waivers have been signed by everyone entitled to distribution).

- A report of administration, including a complete summary of the actions you have taken in your role to administer the estate.

- A petition asking the court to approve the accounting (if filed), approve the distribution of the estate assets, and approve any fees to be paid to the Personal Representative or their attorney. The formula for fee calculation can be found in Probate Code Section 10810.

After you file these documents, the court will set the date for the final probate hearing.

Filing a Judgement of Final Distribution

When you file your Petition for Final Distribution with the court, you should also submit a Judgment of Final Distribution. This is required to be filed at least 10 days prior to the hearing. The Judgment should list every asset in detail as you did on your Inventory and Appraisal. It should outline specifically which heirs and beneficiaries will receive which property from the estate and in what amount.

After the order is approved and signed by the judge, obtain at least one certified copy for your records. If the estate included real property, you’ll also need to record this Order with the County Recorder.

Preparing for the Final Probate Hearing

After filing the Final Petition and receiving a court date for the final hearing, you must give notice of the hearing to all interested people. Here’s how to give notice properly:

- Fill out the front side and top half of the backside of the Notice of Hearing, Form DE-120.

- Have someone who is not a party in the matter, mail or personally deliver the Notice of Hearing form to each person who is entitled to receive notice at least 15 days before the hearing date and include a copy of the petition.

- Have the person who mailed the Notice of Hearing sign the Proof of Service by Mail on the reverse side of the form. File the original Notice of Hearing with the completed Proof of Service by Mail with the Probate Filing Clerk. You only need to file the Notice of Hearing and do not need to file it with the copy of the Petition being attached.

At the final hearing, the Judge will review your documents and hopefully approve the distribution. At that point, you can make distributions to the beneficiaries or heirs of the estate.

Obtaining and Filing Receipts

After you distribute the assets to the heirs or beneficiaries, you need to obtain a receipt from each person who receives estate property. Each receipt should be filed with the court prior to filing a petition for final discharge.

For anyone who received real property, the recording of the Order with the county recorder is considered the receipt for that property.

Releasing Yourself From Liability

After you’ve complied with the terms of the Judgment of Final Distribution and filed the appropriate receipts, the court will make an order discharging you from any future liability. After discharge, you should notify the Internal Revenue Service and the Franchise Tax Board that you’re no longer acting as a fiduciary for the estate.

Closing a probate estate consists of meeting numerous deadlines, filing multiple petitions in legal pleading formatting, and hiring an experienced probate attorney can be very helpful in this process. If you have any questions about how to close a probate estate, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.