3 Faster, Cheaper Alternatives to Probate

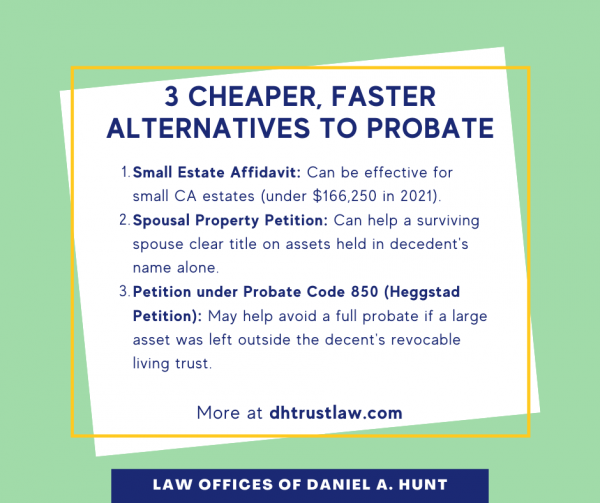

In California, when a loved one dies with or without a will, or with assets left outside of a trust, the family may need to open a formal probate proceeding with the court. However, depending on the circumstances, a full probate may not be the only option. Here are three cheaper, faster alternatives to probate: a Small Estate Affidavit, a Spousal Property Petition, and a Petition under Probate Code Section 850 (aka Heggstad Petition). These alternatives may offer a cheaper and faster way to close the estate than a full probate proceeding if they match your needs.

Probate Alternative #1: Small Estate Affidavit

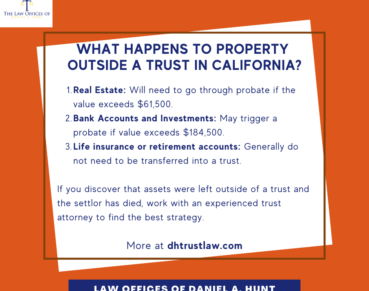

Small estates can often avoid probate with a Small Estate Affidavit. What’s considered a “small estate” in California? In 2024, a small estate is defined as:

- An estate that includes less than $184,500 in personal and real property OR

- An estate that includes only real property worth less than $61,500.

If the estate contains no real property and the whole value of the personal property (including cash assets) is under the $166,250 threshold, then the estate’s personal representative can use a Small Estate Affidavit to claim the property without a court proceeding. If the estate does include real property, then the personal representative will need to file a Small Estate Affidavit with the Probate Court and attend a hearing for court approval of the Small Estate Affidavit.

Assets can be distributed under a Small Estate Affidavit after 40 days have passed since the decedent’s passing. Compare that with waiting 9-18 months of waiting required in an average California probate before assets can be distributed!

Besides being faster, Small Estate Affidavits also cost less than probate. Costs include a $45 filing fee; a probate referee fee of .1% of the appraised value of the assets; and an attorney fee of around $500-$1,000.

Probate Alternative #2: Spousal Property Petition

After one spouse dies, a California Probate Code 13650 Spousal Property Petition can sometimes help the surviving spouse clear title to any assets that were titled in the decedent’s name alone, (and not in joint tenancy). It can also clear title to real property that was held as community property but without the key phrase “with right of survivorship”.

In general, this petition will:

- Describe any property already passing to the surviving spouse

- Propose that the assets in question also pass to the surviving spouse as community property

- Lay out facts supporting this proposition

- Identify heirs who are entitled to notice

- Provide a copy of any written agreement between the spouses pertaining to the property

- Provide a copy of the will (if any)

A Spousal Property Petition can be used for:

- Both community and separate property

- Both decedents who created a will and those who didn’t

- The whole estate or only part

Cost varies based on the amount of work and number of heirs. An average spousal property petition runs around $2,000 plus the court filing fee ($435 in 2021).

Probate Alternative #3: 850 Petition (aka Heggstad Petition)

A Probate Code 850 Petition offers a third alternative to a full probate court proceeding when a decedent failed to properly transfer a sizable asset into a trust, like real property or a bank or investment account. This petition is also known as a Heggstad Petition, named after the landmark 1993 case Estate of Heggstad.

In this case, Halvard L. Heggstad had neglected to transfer his part ownership in a piece of real estate into his revocable living trust. He did, however, list the property on his trust’s Schedule A. The court found that the decedent showed sufficient intent to include this property in his trust. The judge ruled that the property should be included in the trust estate and not go to the decedent’s wife (who he had married shortly before his death).

Today, if a large asset is left outside of a trust, an experienced probate attorney may be able to file a Heggstad petition with the local probate court and request that the asset be included in the trust estate. If the court grants the petition, you’ll save significant time and money compared with a full-blown probate proceeding. The cost for a Heggstad petition includes a filing fee ($435 in 2024) plus around $2,500-4,000 in attorney’s fees.

Finding the best strategy for your unique circumstances requires knowledge of the law and experience working with the probate court. We recommend seeking legal counsel from a skilled probate lawyer who can guide you to the best fit for your personal situation.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.