How to Distribute Trust Assets

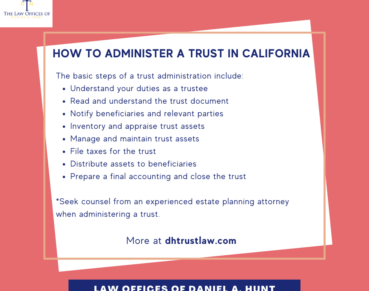

At some point in the process of administering a revocable living trust, you’ll reach a point as a trustee when you’ll be ready to distribute trust assets to the beneficiaries. By then, you will have inventoried the trust assets, liquidated hard assets as appropriate, dealt with any estate debts or creditors, and prepared an accounting of all of your actions as trustee. Once you’re ready to distribute assets, here’s what to do next.

Before Distributing Trust Assets

Before distributing assets, you will want to do the following 3 tasks:

- Determine how the trust assets will be distributed. Most trusts specify a simple “outright” distribution to beneficiaries, without any restrictions. If the trust specifies a staggered or discretionary distribution scheme, consult with your trust attorney for guidance on handling those longer-term scenarios. For the sake of this blog post, we’ll be focusing on a simple, outright distribution scheme.

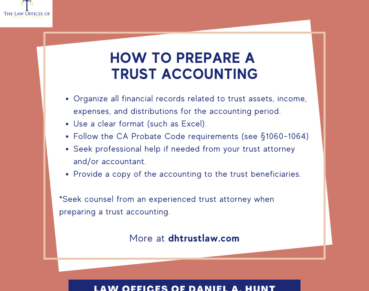

- Prepare an accounting for the beneficiaries and send them a copy, or have your trust attorney prepare an accounting on your behalf. The accounting will show the beneficiaries exactly how you arrived at the amount they will be receiving.

- Decide who will be making the distributions – you or your trust attorney. Communicate that information to your trust attorney.

Two Types of Asset Distribution

Consult with the beneficiaries to figure out what kind of distributions will be made. The two main kinds of distribution are:

- In-Kind Distributions: This includes any titled assets that the beneficiaries have chosen to take as part of their inheritance such as an automobile, a piece of real estate, stock, or investment accounts.

- Cash Distributions: This includes funds from all liquidated assets. You can make this distribution using cash, a cashier’s check, a wire transfer, or a check written from the trust account.

Do’s and Don’ts of Asset Distribution

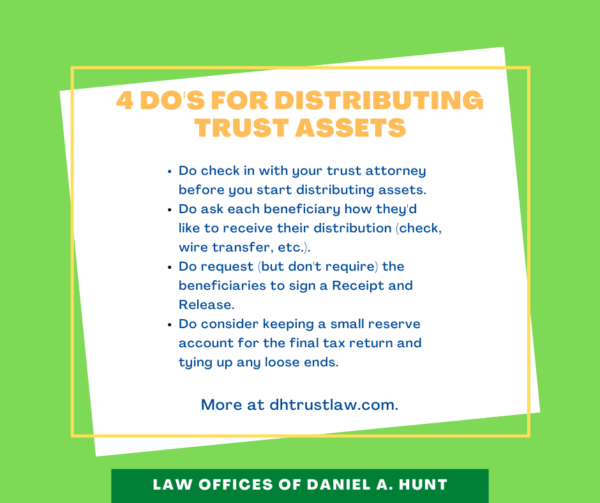

Here are a few Do’s and Don’ts to keep in mind when distributing trust assets.

Do:

- Check-in with your trust attorney before you start distributing assets.

- Ask each beneficiary how they would prefer to receive their distribution, such as whether they would prefer a check versus a wire transfer.

- Request (but don’t require) the beneficiaries to sign a Receipt and Release document when they receive their inheritance. This document acknowledges that the beneficiary has received and accepted the property distributed. It also releases you as the trustee from future liability after a certain amount of time has passed.

- Consider keeping a small reserve account of trust funds for handling the final tax return and tying up any loose ends in the trust administration.

Don’t:

- Don’t try to force a beneficiary to sign a Receipt and Release in exchange for giving them their inheritance. This is against the law.

- Don’t make distributions that are not authorized by the trust document. This includes increasing or decreasing the amount of the distribution as stated in the trust. All trustees have a duty to administer the trust instrument as written and not in any other manner.

If you have any questions about how to distribute assets as a trustee, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.