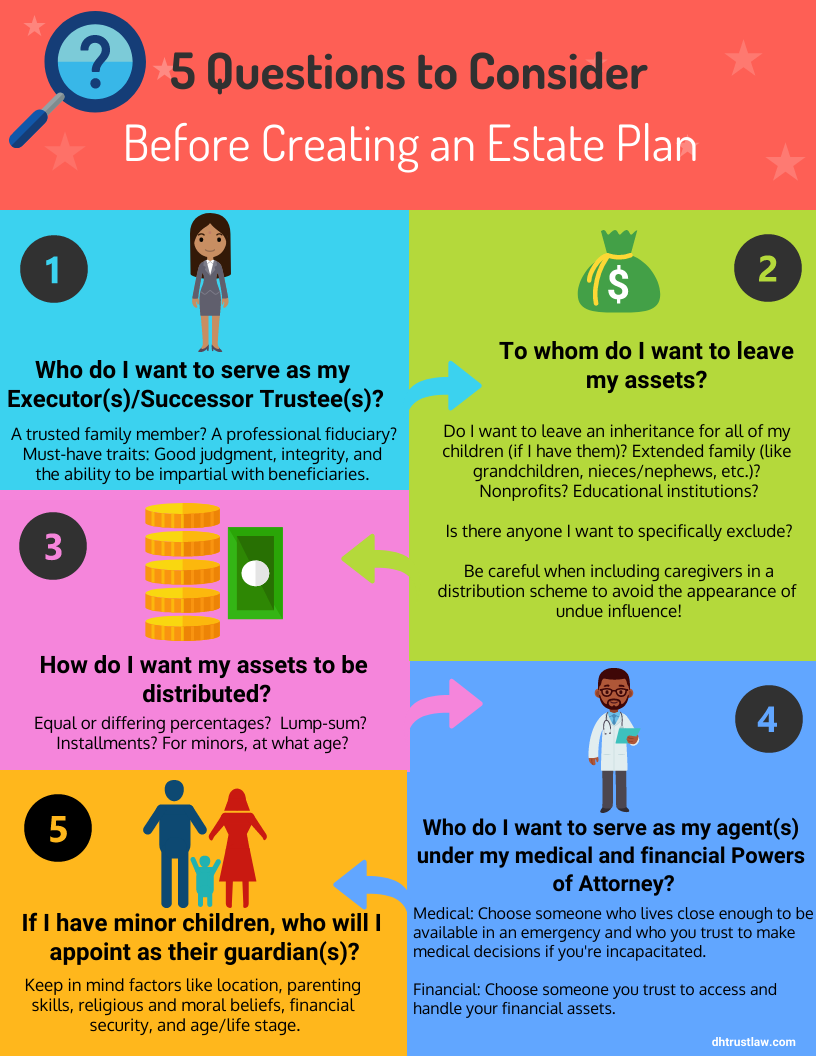

5 Questions to Consider Before Creating an Estate Plan

Creating an Estate Plan doesn’t have to be complicated. The first step is to thoughtfully evaluate your desires for the future until your vision is clear. Then share your ideas with an experienced Estate Planner who can draft legal documents that match your desires.

Here are five simple questions to carefully consider before you meet with an Estate Planning attorney for the first time. These prompts will help you create a crystal-clear vision for your future Estate Plan.

#1 Who do I want to be my Executor(s)/Successor Trustee(s)?

You will probably choose between a revocable living trust-based or Will-based Estate Plan. Revocable living trusts tend to be used by folks with larger California estates to avoid probate, while a simple will may be adequate for very small estates. Both a trust and a will require you to designate a person to administer your estate when you die. In a revocable living trust, this person is called a Successor Trustee. In a will, this person is called an Executor.

Who should you choose to serve in this position? Choose a person who has good judgment and integrity. Many clients choose a trusted child or a close friend to serve in this position. For married couples, their first choice is often their spouse with a trusted family member or close friend as a backup.

When it comes time to administer your estate, your Successor Trustee must be able to communicate with and deal impartially with your beneficiaries. If family dynamics are challenging (like families where the grown children struggle to get along), consider selecting a professional fiduciary to serve as your Successor Trustee. Sometimes it is easier for an outsider to remain unbiased and impartial to all parties in a Trust Administration.

Can you choose to have multiple people serve as Co-Trustees? Yes, but we don’t typically recommend having more than two. Having fewer people involved allows for quicker and easier decision-making. It can also result in a less expensive trust administration since it can be costly to double (or triple!) all communication from the supervising attorney.

#2 To whom do I want to leave my assets?

To whom do you wish to leave an inheritance when you’re gone? Many clients choose to leave their estate equally to their children (if they have children), but that isn’t the only option.

Do you wish to include extended family such as grandchildren, nieces, nephews, etc.? Are there nonprofits or educational institutions you would like to add to your distribution? Be careful of including caregivers in any distribution scheme to avoid the appearance of undue influence.

Now consider if there’s anyone you wish to specifically exclude from your distribution. Common examples include:

- A child who is estranged from the family

- A biological child you placed for adoption long ago

- A child who struggles with addiction for whom a large inheritance would be destructive

- A disabled child who could lose access to government benefits if they receive an inheritance. A better option for them may be a Special Needs Trust.

#3 How do I want my assets to be distributed?

Consider how you’d like to distribute the assets when the time comes. A few examples:

- A lump sum ($5,000 to Bob Smith)

- A percentage of your total estate (25% of my estate equally to my 4 children)

- Installments ($10,000 per year to my niece until the estate assets are gone)

For beneficiaries who are currently minors, you’ll need to decide at what age they will be receiving their full inheritance and no longer have the funds managed by the Successor Trustee for their benefit. Because 18-year-olds don’t always have the best financial judgment yet, the age of 25 is considered standard. But you can adjust this designated age as you deem appropriate.

#4 Who do I want to serve as my agent(s) under my medical and financial Powers of Attorney?

First, let’s discuss your Advance Healthcare Directive (Medical Power of Attorney).

One major factor to consider in choosing an Advance Directive agent is the agent’s location. Choosing an agent who lives near you makes sense for pragmatic reasons. If you experience a medical emergency or become incapacitated, you’ll want your agent to be available as soon as possible.

If you have a family member or friend who has experience in the medical industry, like a nurse, that might be an advantage when it comes to serving as your agent for medical decisions. Sometimes having this field experience helps an agent feel more confident when dealing with medical staff or making well-informed decisions about medical conditions and treatments. However, experience in medical matters is by no means a requirement.

For your Durable Power of Attorney, the most vital consideration is integrity and trustworthiness. Your Power of Attorney agent will have access to many of or all your financial assets. You want to feel comfortable that the person you choose will not abuse that power. Usually, this person is the same as your Successor Trustee(s)/Executor(s) to avoid conflicting powers.

#5 If I have minor children, who do I want to serve as their guardian(s)?

It can be difficult as a parent to imagine someone else raising your children. But designating a guardian allows you to make this choice, rather than a judge who is unfamiliar with you and your family.

To select a guardian, consider who would be best able to meet the physical, financial, and emotional demands of raising your children. Keep in mind factors like location, parenting skills, religious and moral beliefs, financial security, and age/life stage.

Once you’ve answered these five key questions, you should be ready for a smooth initial meeting with your Estate Planning attorney. When your plan for the future is clear and well-constructed, peace of mind will follow. When you’re ready, feel free to contact our law firm to schedule a consultation.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.