2025 California Estate Planning Law Changes

As we step into 2025, significant changes in California estate planning laws are on the horizon. Staying informed about these developments is crucial for effective estate management and ensuring your assets are distributed according to your wishes. Here’s a breakdown of the major 2025 California estate planning law changes and how to adjust accordingly.

Change #1: Federal Estate Tax Exemption Adjustments

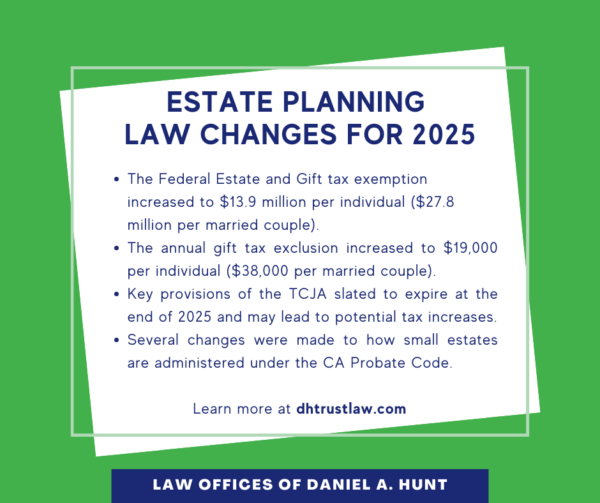

The Tax Cuts and Jobs Act (TCJA) of 2017 substantially increased the federal estate tax exemption, allowing individuals to transfer up to $11.18 million tax-free in 2018, with adjustments for inflation bringing it to $13.9 million per individual (or $27.8 million for married couples) in 2025.

However, this elevated exemption is scheduled to sunset at the end of this year. While it’s possible that this may change, the exemption is anticipated to revert to pre-2018 levels of approximately $5 million per person on January 1, 2026. This is estimated to be around $6.5 million when adjusted for inflation.

This impending reduction underscores the importance of proactive estate planning to minimize potential tax liabilities. Check out our full blog post on how to prepare for the TCJA sunset at the end of this year.

Change #2: Gift Tax Exclusion

The gift tax exclusion amount in 2025 has increased from last year when it was $18,000 per individual or $36,000 per married couple splitting their gifts. The new amount for 2025 will be $19,000 per individual or $38,000 per married couple. This means you can give up to $19,000 to as many people as you wish without those gifts counting against your lifetime exemption.

Change #3: Anticipated Federal Tax Law Changes

The expiration of key provisions of the TCJA in 2025 may lead to potential tax increases. For instance, the top income tax rate could revert from 37% back to 39.6%, and the standard deduction may decrease.

To mitigate potential tax impacts, consult a qualified tax professional to discuss strategies such as accelerating income recognition before rates rise and converting traditional IRAs to Roth IRAs sooner. Since TCJA’s increased estate and gift tax exemptions are set to decrease in 2026, high-net-worth individuals should consider utilizing their exemptions now.

Change #4: Terminating a Trust

California Probate Code §15408 was amended as of January 1, 2025, allowing a trustee to terminate a trust without court approval if the estate is worth less than $100,000.

Change #5: Changes in California Probate Procedures

Effective April 1, 2025, California is implementing a new law that simplifies the transfer of primary residences valued up to $750,000 to heirs without the need for probate or a formal estate plan. This expansion of the small estate affidavit and petition procedures aims to ease the burden on families, making California post-death property transitions faster and less complicated.

It’s important to note a few caveats:

- This law applies only to decedents who pass away after its effective date of April 1, 2025.

- The new process only covers the value of the decedent’s primary residence. If the decedent had multiple properties or if the property is no longer their primary residence, then that piece of real estate will not qualify.

Do Californians Still Need a Revocable Living Trust?

What if your home is worth less than $750,000 and you created a revocable living trust; do you still need a trust?

Even with the new law, most Californians will still benefit from establishing a revocable living trust. With a simplified probate petition, all estate beneficiaries will be on title to real property. This works well if you have a solo beneficiary. But what if you have multiple beneficiaries and wish to sell the family home? Worse, what if they disagree on what to do with the real estate? In many cases, it’s still better to use a trust so a successor trustee can efficiently manage and distribute estate assets.

Revocable living trusts offer other benefits as well. For example, they let you designate guardians for minor children, keeping your kids out of the foster care system if you were to pass away. Trusts also help you avoid a court-appointed conservatorship. If a person becomes ill or incapacitated, their successor trustee can manage their affairs without court intervention.

California Case Law Updates

Here are select 2024 California case law findings that carry valuable takeaways:

- Robinson v. Gutierrez (2023) 98 Cal.App.5th 278. Takeaway: Free room and board does not make you a caregiver.

Summary: The decedent invited a woman to move into her home and perform household duties in exchange for free room and board. The decedent left the house to her caregiver. The decedent’s nieces and nephews filed suit to invalidate the trust, claiming elder abuse, undue influence, etc. The court denied their petition and found that no presumption of undue influence was established because room and board did not constitute remuneration for purposes of qualifying as a care custodian under PC 21362.

- Haggerty v. Thornton (2024) 15 Cal.5th 729. Takeaway: An amendment can be made using the “statutory method” and may be valid even if not notarized. However, it’s always best to work with an experienced estate planner to ensure amendments are executed properly and avoid potential conflicts.

Summary: A woman created a trust that included the following reservation of rights: “The right by an acknowledged instrument in writing to revoke or amend this Agreement or any trust hereunder.” She later created an amendment excluding her niece. The niece disputed the amendment because it was signed but not notarized. The court held that the final amendment was valid because the settlor complied with the statutory method of signing and delivering the amendment to herself as trustee.

- Reich v. Reich (2024) 105 Cal.App.5th 1282. Takeaway: If you get married, always update your estate plan, including updating account beneficiaries as desired.

Summary: A man created a revocable trust which created sub-trusts for his daughter and granddaughter after his death. He named these sub-trusts as the designated beneficiaries of his IRA, worth over $1.5 million. He later got married and then passed away a few months later. His wife filed a petition seeking an omitted spouse’s share of Thomas’s estate. The court dismissed Pamlea’s petition because IRA proceeds are a non-probate asset and would be distributed directly to the sub-trusts and not subject to probate estate claims by an omitted spouse.

- Trotter v. Van Dyck (2024) 103 Cal.App.5th 126. Takeaway: Never try to amend your trust on your own, especially not by simply sending an email! Always work with a skilled estate planning attorney who knows how to properly amend a trust.

Summary: A woman sent her son an email contemplating amending her trust and died shortly afterward. The probate court determined Mary’s writings were insufficient to constitute an amendment.

Proactive Steps to Consider

Given these upcoming changes, it’s best to take the following steps:

- Review and Update Your Estate Plan: Consult an experienced estate planning attorney to ensure your estate plan reflects the current laws and your personal circumstances.

- Utilize the Current Federal Estate Tax Exemption: Consider making substantial gifts before the exemption decreases in 2026 to minimize future estate tax liabilities.

- Explore Trusts and Other Estate Planning Tools: Establishing revocable and/or irrevocable trusts can provide control over asset distribution and offer potential tax benefits.

- Stay Informed: Regularly consult with estate planning professionals to stay abreast of legislative changes that may impact your estate.

By taking these proactive steps, you can navigate the evolving estate planning landscape in California and ensure your legacy is preserved for future generations.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.