2020 Estate Planning Law Changes

What 2020 Estate Planning law changes should you be aware of? The law is always changing, which keeps us Estate Planners on our toes. Every year, we update our clients on Estate Planning law changes. In 2019, there was a high volume of cases litigated in the California court system, which resulted in plenty of new state laws. Here are our top 6 Estate Planning law changes to consider in 2020.

Handwritten Amendments Are Not Valid

Pena v. Dey demonstrates why you should never attempt to draft a “homemade” amendment. In this case, a Settlor named James Anderson wrote the name of an additional beneficiary (Gary Dey) on the First Amendment to his Trust and sent it to his attorney to draft a second amendment.

Before the drafting could occur, Anderson died. The successor trustee (Pena) felt that the handwritten interlineations did NOT constitute a valid amendment; the would-be beneficiary (Dey) asserted that it did and that he should inherit.

The court decided that the handwritten interlineations did not constitute a valid amendment because the trust specifically required amendments “be made by written instrument signed by the settlor and delivered to the trustee. … While the law considers the interlineations a separate written instrument, and while there can be no doubt Anderson delivered them to himself as trustee, he did not sign them.”

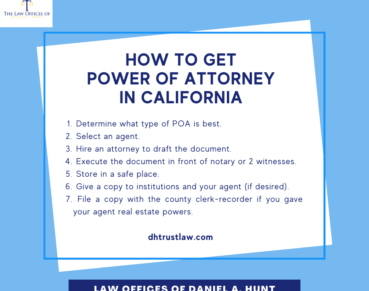

Moral of the story: Never attempt to modify your Estate Plan on your own without the help of an experienced Estate Planning attorney.

Fiduciary Duties Between Spouses

New Probate Code §21385 holds that at death, spousal transfers by will, revocable trust, beneficiary form, or other testamentary document are not subject to a presumption of undue influence.

Therefore, go ahead and leave whatever you want to your spouse. Rest assured that no one will assume they forced you into doing it. We all know that our spouses never force us to do anything we don’t want to do. Glad to know it is black letter law now.

Small Estate Transfers

Previously, the threshold amount for an estate to trigger probate was $150,000 for estates with no real property. That amount increased to $166,250 for estates with no real property. For estates that include real property, the amount also increased from $50,000 to $55,425.

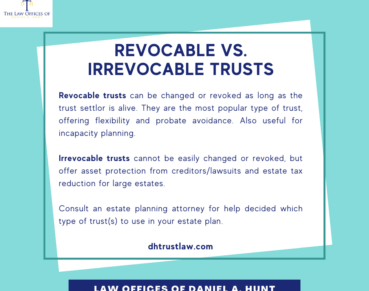

Although this is good news to avoid Probate, we never recommend testing these limits with your own estate. Check your asset titles to ensure they are all properly transferred in your revocable trust to avoid Probate when you eventually don’t wake up.

Increased Exemption Amounts

The Federal Estate Tax exemption increased in 2020 to $11.58 million per person. Therefore, if you have less than $11.58 million to leave to your loved ones, a charity, dog, or cat, it will pass estate tax-free!

The annual gift exclusion remained unchanged at $15,000. So any kids still on your “payroll” will not be getting a raise this year, at least not tax-free.

Secure act and Stretch IRAs

The stretch IRA has largely been eliminated due to the SECURE ACT . You can still leave your IRA to your spouse and they will be able to establish a spousal rollover and continue deferring withdrawals and tax payments over their lifetime, but almost everyone else is now limited to 10 years.

Like most everything that comes from Washington, D.C., it is extremely complicated to determine all of the exceptions to this general rule. Please consult someone who likes to read laws for a living before you start changing around your IRA beneficiaries.

Trust Decanting

Although trust decanting came about last year, we want to remind you that if you’re a surviving spouse with an allocated A/B trust (meaning the trust was split after the first spouse passed), you may want to explore trust decanting… That is unless you like paying more taxes than is legally required of you. For everyone else, trust decanting can completely wipe out all Capital Gains Tax on your estate. Contact an experienced Estate Planning attorney to discuss your options.

That’s it for this year! Feel free to contact our law firm if you have any questions or would like to schedule a trust review appointment.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.